“Discover how Agentic AI is transforming WealthTech—autonomous advisors, multi-agent architecture, compliance, and future trends in wealth management

🌟 Introduction: The Wealth Advisor That Never Sleeps

Imagine a financial advisor who can analyse thousands of portfolios overnight, suggest goal-based plans, rebalance investments in seconds, and talk to you in plain English—or your native language.

That’s not science fiction anymore. Agentic AI—AI systems capable of acting autonomously to achieve specific goals—is reshaping the entire wealth-management industry. In this article, we’ll break down what Agentic AI means in WealthTech, why it matters for both investors and firms, the building blocks of such platforms, and where the future is headed.

🧩 What is Agentic AI?

Agentic AI refers to AI-powered software “agents” that can understand goals, reason about actions, and take steps—often across multiple apps or APIs—to achieve those goals with minimal human input.

In WealthTech, that means:

- Understanding investor goals: retirement, tax-efficient investing, or saving for a child’s education.

- Acting on behalf of the user: rebalancing portfolios, alerting on risks, executing trades, or updating KYC data.

- Learning continuously: improving advice based on new market data and user behaviour.

Think of it as moving beyond traditional robo-advisors (which mostly follow predefined rules) to autonomous AI agents that can plan, execute, and adapt.

💡 Why Wealth Firms Are Turning to Agentic AI

Wealth managers globally face four key challenges:

- High operational costs due to manual client onboarding, compliance, and rebalancing.

- Demand for personalized advice at scale across mass-affluent and NRI/HNI segments.

- Tight regulations & compliance needs (SEBI, MiFID II, SEC, MAS, etc.).

- Competitive pressure from fintech’s and big-tech entrants.

Agentic AI addresses these by:

- Reducing costs: automating repetitive workflows (onboarding, suitability checks).

- Scaling personalization: tailoring portfolios to micro-segments or even 1-to-1.

- Boosting client experience: offering 24×7, multilingual guidance.

- Improving compliance: generating explainable decision trails

📊 Benefits for Investors & Firms

For Investors

- Always-on advisor: available 24×7 across mobile, WhatsApp, or web chat.

- Faster decisions: instant portfolio diagnostics and recommendations.

- Lower advisory fees: due to operational efficiency.

- Goal-aligned strategies: AI adapts to life events (marriage, children, retirement).

For Wealth Firms

- Up to 40–60% cost savings in onboarding and middle-office operations.

- Data-driven cross-selling: better matching of products to customer profiles.

- Stronger retention: hyper-personalized nudges improve customer stickiness.

- Regulatory readiness: automatic record-keeping of recommendations

🏗️ Designing an Agentic AI-Powered Wealth Platform

Here’s a five-step sequence for product owners and tech teams:

- Define Product Vision & Goals

- Examples: automated KYC & onboarding, risk-based portfolio rebalancing, global tax optimization.

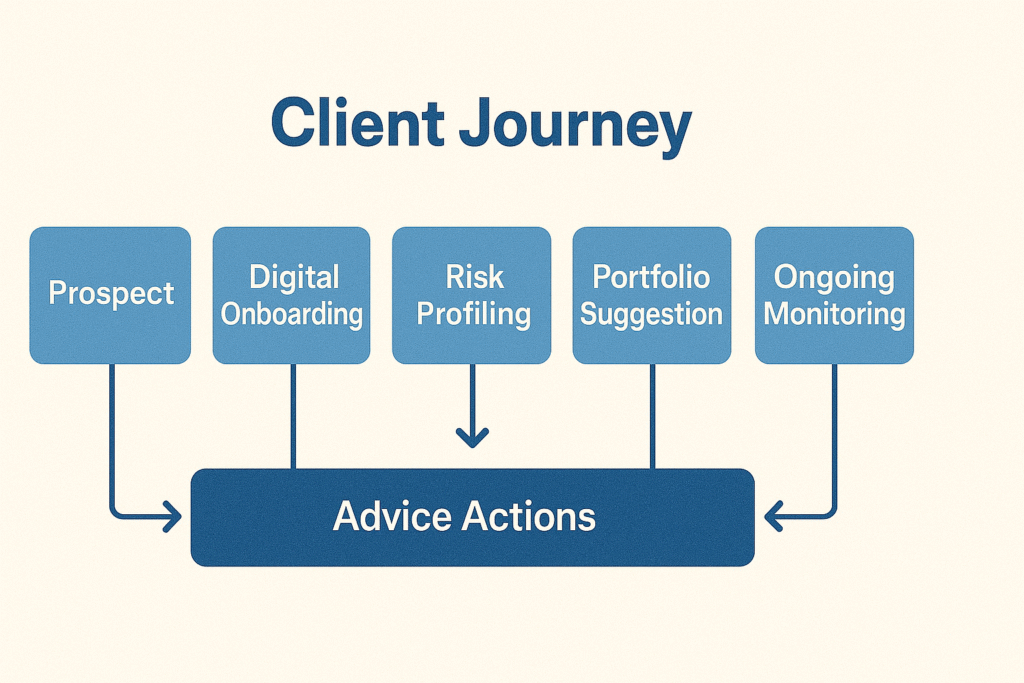

- Map Investor Journey

- Hero Chart: Client-Journey Map – Prospect → Digital Onboarding → Risk Profiling → Portfolio Suggestion → Ongoing Monitoring → Advice Actions.

- Select AI Core & Agents

- Use a multi-agent system:

- Data Ingestion Agent: pulls live market, ESG, & macro data.

- Risk Agent: runs stress tests.Advice Agent: suggests allocation & rebalancing.

- Compliance Agent: ensures SEBI/SEC rules before execution.

- Design Human-in-the-Loop Controls

- Advisors supervise AI actions for high-net-worth clients.

- Integrate APIs & Compliance Layers

- Connect with trading, KYC, CRM, AML, and reporting systems

🔗 Architecture Snapshot

🔥 Future Trends to Watch (2025–2030)

- Multi-modal financial assistants: integrating text + voice + AR dashboards.

- ESG & Impact Investing agents: AI that optimizes for carbon footprint & social impact.

- Personalized tax agents: cross-border tax optimization for NRIs.

- AI-driven estate & retirement planning: deeper life-event modelling.

- Federated & privacy-preserving AI: compliant with India’s DPDP Act, EU’s GDPR.

- Blockchain-based agent settlement: faster cross-border payments

📝 Steps for Wealth Firms to Get Started

- Begin with one high-impact use case (e.g., automated onboarding).

- Pilot with synthetic data & sandbox environments.

- Ensure explainability & audit trails for every recommendation.

- Partner with FinTech vendors or build in-house multi-agent frameworks.

- Train teams—BA/PO, compliance, and advisors—to supervise AI actions

💬 Key Takeaways

Agentic AI isn’t replacing human advisors—it’s augmenting them to deliver personalized, compliant, and cost-efficient services at scale.

Wealth firms that adopt early can improve client trust, reduce costs, and build competitive moats

🚀 Conclusion

The journey from robo-advisors to agentic, autonomous advisory platforms is underway. By embracing this shift now—building human-AI partnerships and focusing on explainability—WealthTech players can unlock new opportunities for millions of investors worldwide.