Discover how Agentic AI and Large Language Model (LLM) Agents automate KYC, risk profiling, and portfolio rebalancing — simplifying wealth management

🌍 Introduction: From Manual to Autonomous Wealth Management

Think about your last financial task — verifying your identity, filling a risk-profiling form, or adjusting your investment portfolio.

Now imagine a world where all of this happens automatically — accurately, securely, and in real-time — powered by Agentic AI and Large Language Model (LLM) Agents.

Welcome to the new era of intelligent wealth management — where AI systems don’t just assist humans; they act like humans, making financial workflows faster, more compliant, and deeply personalized.

This article breaks down how these intelligent agents are revolutionizing KYC (Know Your Customer), Risk Profiling, and Portfolio Rebalancing — three pillars of modern financial services.

🧠 Understanding Agentic AI and LLM Agents

🧩 What Is Agentic AI?

Agentic AI refers to artificial intelligence systems that can act independently toward a specific goal using reasoning, memory, and feedback loops.

Unlike traditional AI models that require constant instructions, agentic AI can:

- Analyze data

- Make context-based decisions

- Execute tasks automatically

- Learn continuously from outcomes

In wealth management, this means AI systems that can analyse client data, suggest actions, and even implement investment decisions — all while staying compliant

🗣️ What Are Large Language Model (LLM) Agents?

Large Language Models (like GPT or Gemini) are AI systems trained on massive datasets of text and code.

When combined with agentic frameworks, they evolve into LLM Agents — capable of:

- Understanding human language and context

- Conducting conversations naturally

- Connecting to APIs, databases, and fintech tools

- Executing step-by-step financial workflows autonomously

In simpler words, LLM Agents = AI Advisors that talk, think, and act.

🧠 Agentic AI + LLM Agents = The Smartest Financial Assistant

When you combine Agentic AI’s reasoning with LLM’s conversational understanding, you get autonomous systems that can handle complex, regulated workflows in wealth management.

🏦 1. Automating KYC (Know Your Customer) with Agentic AI

🧾 The Problem: Manual KYC = Slow, Costly, Error-Prone Traditional KYC involves collecting IDs, verifying documents, checking databases, and logging audit trails — often done manually by back-office teams.

This process can take days and increase onboarding costs significantly

⚙️ The Solution: AI-Powered, Autonomous KYC

Agentic AI systems can automate the entire KYC journey end-to-end:

🔄 Step-by-Step Sequence:

- Data Capture – Extracts customer info using OCR (Optical Character Recognition) from uploaded documents.

- Identity Verification – Compares face, signature, and ID using computer vision models.

- Database Check – Integrates with APIs for AML (Anti-Money Laundering) and sanctions screening.

- LLM-Driven Reasoning – Interprets KYC anomalies and generates audit notes in plain English.

- Decision Engine – Approves or flags cases for compliance officer review.

💡 Benefits of AI-KYC

| Benefit | Explanation |

| Speed | Instant identity checks within minutes instead of days |

| Accuracy | Near-zero human error with machine-based verification |

| Scalability | Handles thousands of KYC requests simultaneously |

| Compliance | Built-in regulatory rule engines (FATF, SEBI, FINTRAC) |

| User Experience | Seamless onboarding across web & mobile |

📊 2. AI-Driven Risk Profiling: Understanding Investors Like Humans Do

💬 The Challenge Human advisors spend hours asking clients about their income, goals, and risk tolerance — but answers can be inconsistent, subjective, and hard to quantify

🤖 The AI-LLM Solution

LLM Agents can converse like a financial planner — analyzing tone, keywords, and context — while Agentic AI models translate responses into actionable financial insights.

💡 Step-by-Step AI Risk Profiling Flow

- Interactive Chat Interface – LLM agent conducts a natural-language interview (“Tell me about your investment goals”).

- Sentiment Analysis – AI detects optimism, fear, or uncertainty in answers.

- Quantitative Scoring – Risk algorithms assign numerical tolerance scores.

- Dynamic Profiling – AI adjusts risk appetite automatically as client data changes.

- Feedback Loop – Results feed back into portfolio models and compliance systems

🧮 Benefits of AI Risk Profiling

| Benefit | Description |

| Personalized | Adapts to lifestyle, emotions, and real-time financial data |

| Continuous Updates | Profile evolves as markets and goals change |

| Emotion Detection | Understands fear, greed, or overconfidence in clients |

| Regulatory Alignment | Automatically maps answers to risk categories (Conservative, Balanced, Aggressive) |

🧩 Example

Imagine an investor says:

“I’m nervous about market drops, but I still want some growth.”

A human might interpret this vaguely.

An LLM-powered AI agent instantly categorizes this as Moderate Risk, balances equity vs. debt allocation, and logs the reasoning transparently for compliance.

💰 3. Portfolio Rebalancing: Intelligent, Real-Time Adjustments

📉 The Traditional Way

Portfolio rebalancing is often periodic — monthly or quarterly — and heavily manual.

Advisors check deviations, analyse market performance, and then recommend changes. This process is slow and reactive.

⚙️ The AI Way: Continuous & Autonomous

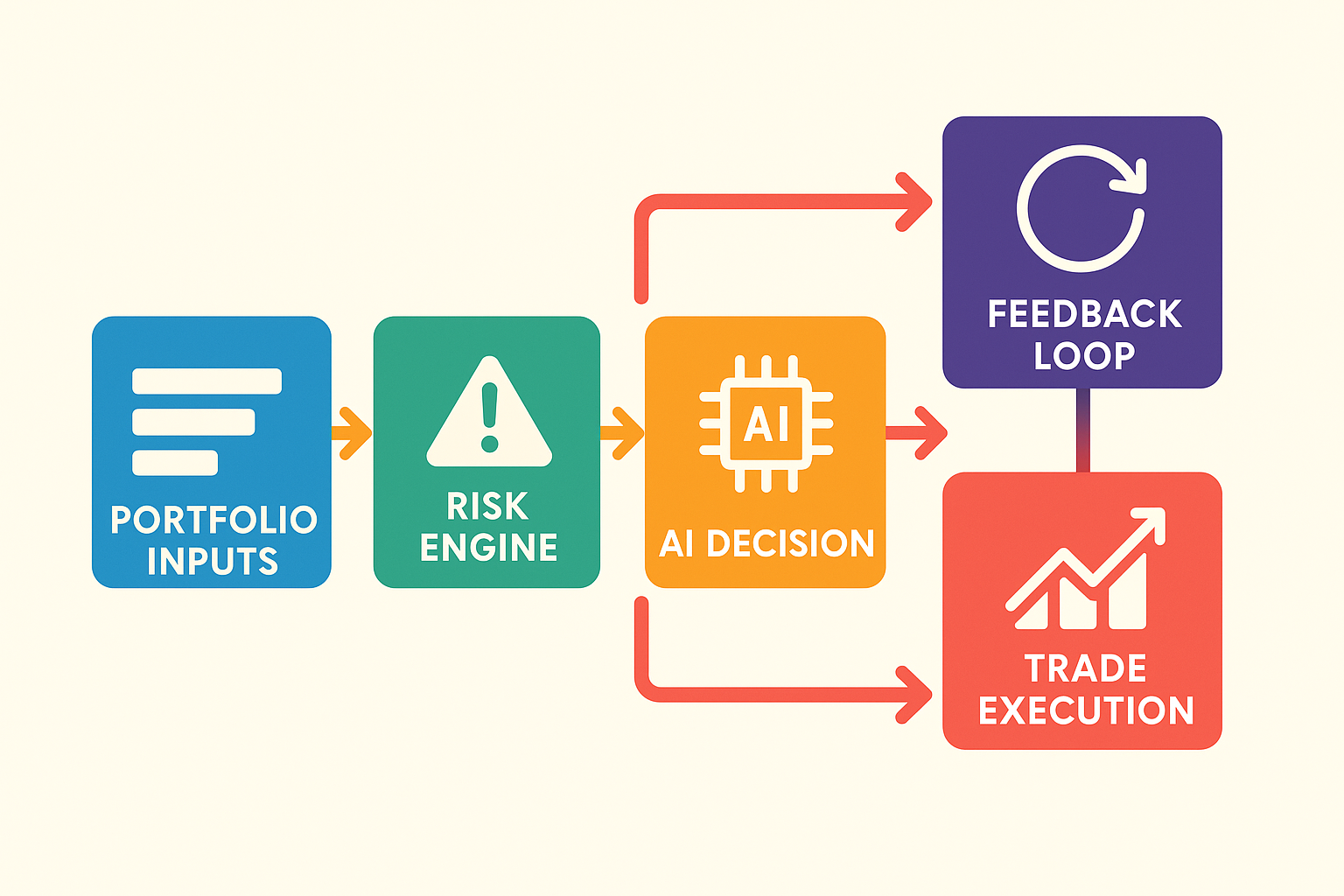

Agentic AI systems use autonomous decision loops to monitor portfolios continuously and rebalance automatically when needed.

🧠 AI Workflow Sequence

- Data Ingestion – AI fetches market data, asset prices, and portfolio weightages in real-time.

- Deviation Detection – Identifies drift beyond pre-set thresholds.

- LLM Reasoning – Explains rationale in human terms (“Equity overweight due to market surge”).

- Execution Layer – Automatically triggers rebalancing via broker APIs.

- Audit & Feedback – Logs every action for transparency and learning

🌟 Benefits of AI Portfolio Rebalancing

| Benefit | Explanation |

| 24/7 Monitoring | AI never sleeps — tracks all portfolios in real-time |

| Emotion-Free Decisions | No panic selling or over-optimism |

| Cost Efficiency | Fewer manual analysts and faster execution |

| Performance Optimization | Better returns through timely, rule-based adjustments |

| Explainability | Each trade decision is documented in plain language |

4 🔒 Compliance & Transparency: The Core of AI Automation

No automation is complete without trust and auditability.

Agentic AI systems are built with Explainable AI (XAI) and RegTech integration — ensuring every action is justified and traceable.

⚖️ Key Compliance Features:

- KYC Audit Logs: Every client verification step is timestamped and recorded.

- Regulatory Mappings: MiFID II, SEBI, or FINRA standards embedded in algorithms.

- Explainable Outputs: Each AI decision includes a human-readable summary.

- Anomaly Detection: AI flags suspicious transactions automatically.

💬 Example:

“Client’s risk profile has shifted from Moderate to Aggressive due to income increase — system recommends adjusting equity ratio.”

That’s not just automation — it’s AI governance in action.

| Layer | Description |

| LLM Agents | Understand natural language, handle user interaction |

| Agentic AI Layer | Executes logic, decisions, and continuous learning |

| API Gateway | Connects with KYC, brokerage, and analytics systems |

| Data Lake | Stores transactions, logs, and performance data |

| Compliance Engine | Validates every action against regulations |

5 🌐 Real-World Applications (2025 & Beyond)

| Company | Innovation |

| JP Morgan COIN | AI contract intelligence for compliance |

| Wealthfront 2.0 | Automated tax-loss harvesting with AI agents |

| Kristal.AI & Quantela | Hybrid human + AI advisory |

| Finbox, Plaid, DriveWealth | API ecosystems enabling real-time automation |

🔮 Future Trends (2025–2030)

| Trend | Impact |

| Multi-Agent Systems | Specialized AI agents for KYC, trading, and compliance collaborating autonomously |

| Voice-Based Advisory | Talk to your AI wealth manager via Alexa-style assistants |

| Emotion-Aware AI | Detects stress or bias before executing trades |

| DeFi + AI Integration | Cross-border asset management on decentralized ledgers |

| Zero-Touch Onboarding | 100% AI-managed client journeys from signup to investment |

💡 Practical Tips for Wealth Managers

- Start Small – Automate just KYC or risk profiling first.

- Choose Secure APIs – Partner only with audited fintech API providers.

- Invest in Explainability – Use dashboards showing AI reasoning.

- Maintain Human Oversight – AI assists, humans approve.

- Train Your Teams – Educate advisors on how to interpret AI outputs

🧭 Conclusion: From Automation to Autonomy

The convergence of Agentic AI and LLM Agents marks the next leap in financial innovation.

These systems are not just automating routine tasks — they’re building intelligent, compliant, and adaptive wealth ecosystems that can understand clients as humans do and act as efficiently as machines can. In the coming years, wealth management will be defined not by “who manages your money”, but by “how intelligently it’s managed.” And that’s the power of Agentic AI in action.