Discover how Agentic AI-driven wealth platforms combine architecture, APIs, and compliance to create smarter, autonomous financial ecosystems.

🌍 Introduction: The Future of WealthTech Is Agentic AI

Imagine if your wealth management app didn’t just track your portfolio but could think, decide, and act like a financial expert — automatically rebalancing assets, detecting compliance risks, and optimizing returns in real time.

That’s what Agentic AI-Driven Wealth Platforms aim to achieve — intelligent systems capable of autonomous decision-making, real-time compliance, and personalized financial guidance.

By combining AI agents, API-driven architecture, and regulatory intelligence, modern wealth platforms are no longer static dashboards — they’re living, learning financial ecosystems.

Let’s break this down in simple, practical terms.

🧠 What Is an Agentic AI Wealth Platform?

An Agentic AI Wealth Platform is a next-generation digital system that uses autonomous AI agents to handle complex financial processes such as:

- Portfolio rebalancing

- Risk profiling

- Market analysis

- Client onboarding

- Compliance reporting

🔍 Definition:

Agentic AI refers to AI systems that can make independent, goal-oriented decisions based on data, predefined rules, and continuous learning — reducing the need for manual supervision.

So unlike a traditional robo-advisor (which executes predefined rules), an Agentic AI system can reason, self-correct, and adapt to changing markets or client preferences.

⚙️ The Core Architecture: How It All Works

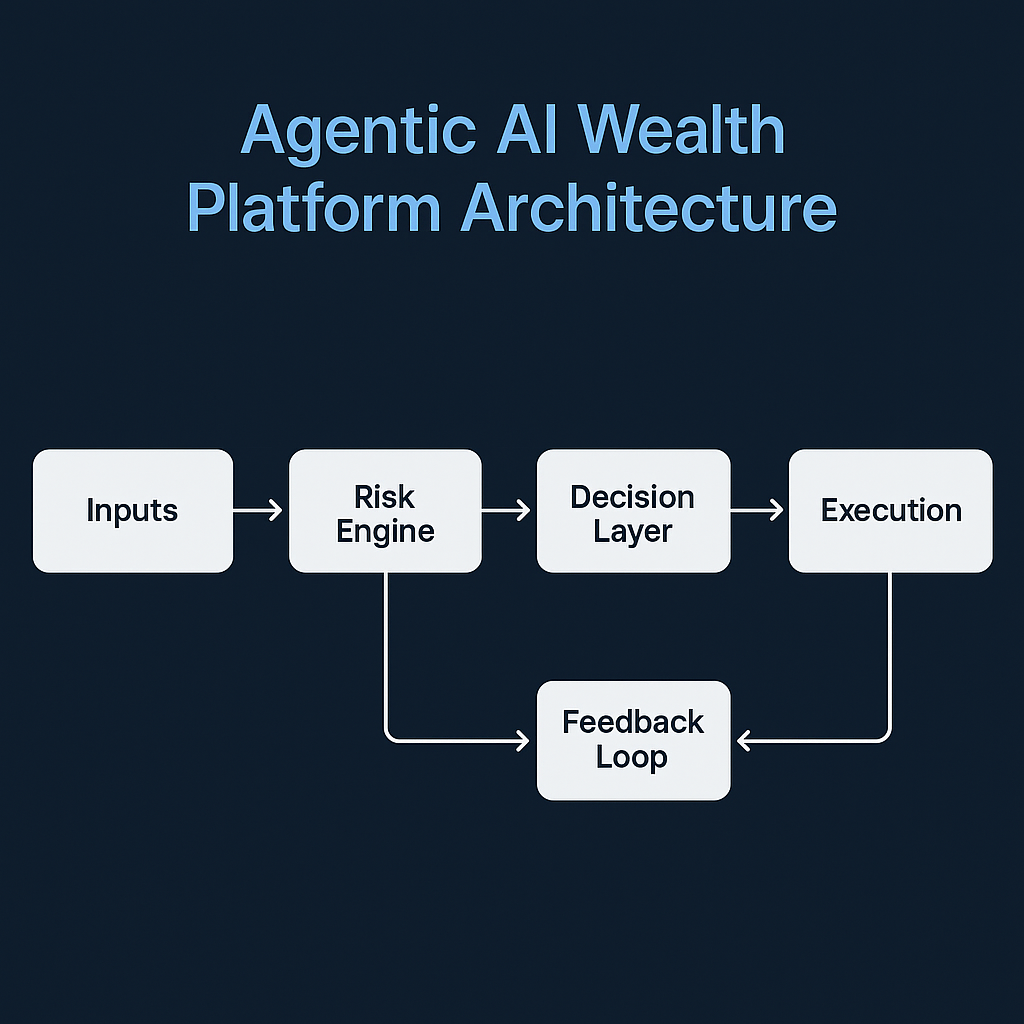

To build an intelligent wealth platform, developers follow a modular architecture that connects multiple layers — from data inputs to autonomous actions.

Here’s a simplified workflow diagram:

🧩 Agentic AI Wealth Platform Architecture

| Layer | Function | Example Technologies |

| Data Inputs | Collect data from KYC, market APIs, CRM, transactions | REST APIs, Plaid, Finbox, Alpha Vantage |

| AI Risk Engine | Analyze investor profile, behavior, and risk capacity | Machine Learning, NLP, Sentiment Analysis |

| Decision Layer | Generate personalized investment advice and insights | Reinforcement Learning, Predictive Analytics |

| Execution Layer | Execute trades, rebalancing, and reports automatically | Broker APIs, Algo-trading modules |

| Feedback Loop | Learn from outcomes to improve next recommendations | AI Monitoring, A/B Testing, Explainable AI |

🏗️ Why This Architecture Works

- Scalable: Easily integrate new APIs (e.g., tax calculators, ESG scores).

- Adaptive: Learns from market conditions and user actions.

- Compliant: Embeds rule-based compliance checks at every step

🔗 The Role of APIs: The Connective Tissue of WealthTech

APIs (Application Programming Interfaces) are the lifelines of modern financial platforms. They connect data, AI engines, and services seamlessly — like pipes in a digital financial network

💼 Key API Categories in Wealth Management

| API Type | Purpose | Examples |

| Market Data APIs | Real-time stock, crypto, and fund data | Bloomberg, Yahoo Finance, Alpha Vantage |

| KYC/AML APIs | Identity and compliance verification | Signzy, Trulioo, Onfido |

| Payment & Banking APIs | Transactions, deposits, payouts | RazorpayX, Stripe, Open Banking APIs |

| Portfolio APIs | Position management, performance metrics | Morningstar, Plaid, DriveWealth |

| Advisory & Robo APIs | Automated advice generation | QuantConnect, Riskalyze |

| Analytics & Reporting APIs | Dashboards and client analytics | Power BI, Tableau Embedded, Snowflake |

🧠 Why APIs Matter

- Enable real-time connectivity between tools and markets.

- Reduce cost and time by reusing third-party data services.

- Make it possible for small startups to build enterprise-grade systems without heavy infrastructure

💡 Benefits of Agentic AI Wealth Platforms

| Benefit | Description |

| 1. Hyper-Personalization | AI understands client goals, emotions, and behaviors. |

| 2. Automation Efficiency | Tasks like rebalancing, alerts, and onboarding become hands-free. |

| 3. Compliance Assurance | Built-in rule engines ensure regulatory alignment (MiFID II, SEBI, FINRA). |

| 4. Scalable Growth | APIs allow new features to be added modularly. |

| 5. Cost Reduction | Reduces dependency on manual teams and middle-office operations. |

| 6. Continuous Learning | Feedback loops improve accuracy with every transaction. |

🧩 Example Flow: Agentic AI in Action

- Client signs up → AI KYC verifies identity.

- Risk profiling → System assesses risk appetite via questionnaire + behaviour.

- Goal setting → Defines savings, retirement, or education goals.

- AI portfolio generation → Suggests assets via market pattern recognition.

- Execution engine → Places trades via broker APIs.

- Compliance check → System validates actions under regulations.

- Feedback loop → Learns from returns, adjusts models automatically

🛡️ Compliance: The Non-Negotiable Backbone

When money and algorithms meet, compliance must lead innovation.

AI-driven wealth platforms must integrate RegTech (Regulatory Technology) to ensure transparency, security, and fairness.

⚖️ Key Compliance Areas

| Regulation Focus | Compliance Implementation |

| KYC/AML | Automated ID verification & transaction monitoring |

| GDPR / Data Privacy | Encryption, consent management, and anonymization |

| SEBI / MiFID II / FINRA | Suitability and risk documentation for each client |

| Audit Trails | Blockchain-based recordkeeping for every AI decision |

| Explainable AI (XAI) | Every automated action must have a clear reason code |

🚀 Future Trends in Agentic AI Wealth Management (2025–2030)

| Trend | Impact |

| Multi-Agent Ecosystems | Different AI agents (risk, compliance, portfolio) collaborate autonomously. |

| Voice-Driven Wealth Assistants | Clients will speak to AI planners like Alexa for finance. |

| Emotion-Aware Advisory | AI detects stress or overconfidence and adjusts advice. |

| AI-Blockchain Integration | Smart contracts for real-time compliance and settlement. |

| Open Banking 3.0 | Seamless data sharing between global financial institutions. |

| Personalized AI ETFs | AI dynamically creates ETF baskets based on your goals. |

🧩 Step-by-Step: How to Build an Agentic AI Wealth Platform

- Define Your User Goals

– Who are your clients? Retail investors, advisors, or institutions?

– Define financial objectives (e.g., passive investing, goal-based planning). - Design a Modular Architecture

– Separate AI, API, and Data layers.

– Use microservices for easy scaling. - Integrate Trusted APIs

– Select reliable market data, KYC, and brokerage APIs.

– Ensure 99.9% uptime and regulatory compliance. - Build the AI Decision Engine

– Use machine learning for predictions and reinforcement learning for optimization.

– Implement explainable outputs for compliance. - Embed RegTech from Day One

– Incorporate KYC, AML, and audit logs into your codebase. - Develop Dashboards & Alerts

– Provide visual insights for users and compliance officers. - Test, Learn, and Optimize

– Run simulations on historic data.

– Use A/B testing for user flows and recommendations.

📉 Challenges in Implementation

| Challenge | Possible Solution |

| Data Silos | Use unified data lakes and API integration hubs. |

| Compliance Complexity | Partner with RegTech startups or API providers. |

| High Initial Costs | Adopt modular open-source AI frameworks. |

| Bias in AI Models | Train with diverse, verified datasets. |

🧭 Conclusion: The Rise of Intelligent Wealth Ecosystems

Agentic AI is transforming wealth management from reactive to proactive.

Tomorrow’s wealth platforms won’t just show your portfolio—they’ll understand your life goals, predict your financial risks, and act on your behalf to safeguard your future.

If you’re building a WealthTech startup or reimagining an existing advisory system, focus on:

- Modular architecture for flexibility

- API-first design for scalability

- Compliance automation for trust

- Explainable AI for accountability

The future of finance will belong to those who blend intelligence with integrity — and that’s exactly what Agentic AI Wealth Platforms represent.