Agentic AI is transforming real-time fraud detection in payments. Learn how autonomous AI agents prevent fraud, reduce losses, and improve security

✨ Introduction: Why Fraud in Payments Is No Longer a “Future Problem”

Imagine you’re making a simple UPI payment or tapping your card at a store.

Behind the scenes, hundreds of checks happen in milliseconds — location, device, spending pattern, merchant behavior, and more.

Now imagine fraudsters evolving faster than traditional systems.

That’s exactly where Agentic AI comes in.

In 2025, real-time fraud detection is no longer rule-based or reactive. It’s autonomous, adaptive, and proactive — powered by AI agents that think, decide, and act on their own.

This article explains:

- What Agentic AI really means (in simple words)

- How it works in the payment domain

- Why banks, fintechs, and payment gateways are adopting it fast

- Real-world benefits, architecture, and future trends

Let’s break it down step by step 👇

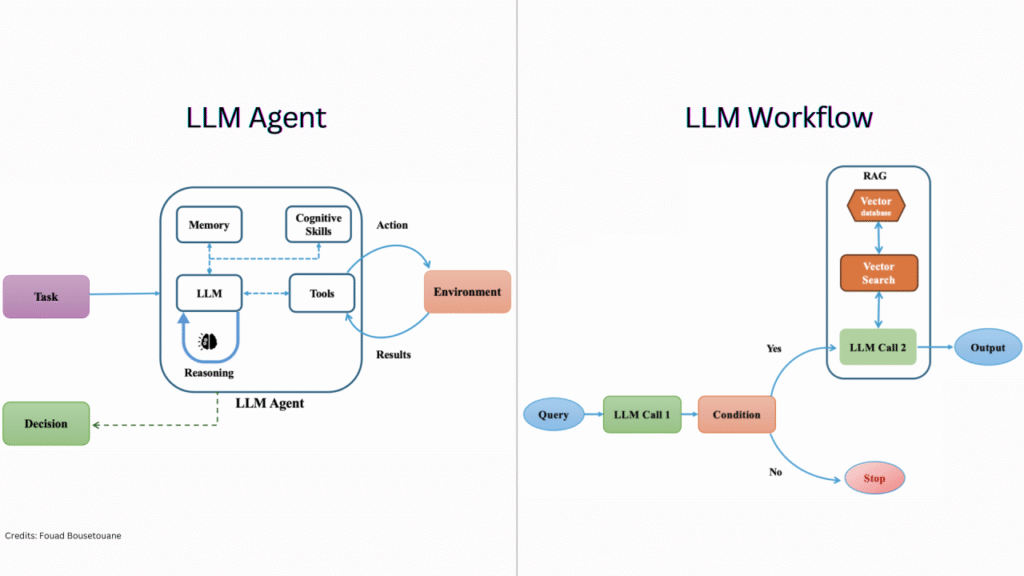

🧠 What Is Agentic AI? (Simple Definition)

Agentic AI refers to autonomous AI agents that can:

- Observe data in real time

- Make independent decisions

- Take actions without human intervention

- Learn continuously from outcomes

In simple terms:

Agentic AI behaves like a smart digital employee who doesn’t wait for instructions every time.

🧠 How It’s Different from Traditional AI

| Traditional AI | Agentic AI |

| Reacts to inputs | Acts autonomously |

| Fixed workflows | Dynamic decision paths |

| Limited context | Full situational awareness |

| Human approval needed | Self-executing actions |

📲 Why the Payment Domain Needs Agentic AI (Urgently)

Payment fraud today includes:

- UPI fraud

- Card-not-present fraud

- Account takeover

- Merchant fraud

- Synthetic identity fraud

- Friendly fraud (false chargebacks)

🚨 The Core Problem

Traditional fraud systems:

- Depend heavily on static rules

- Generate high false positives

- Block genuine customers

- React after damage is done

Agentic AI flips this approach

🔍 How Agentic AI Works in Real-Time Fraud Detection

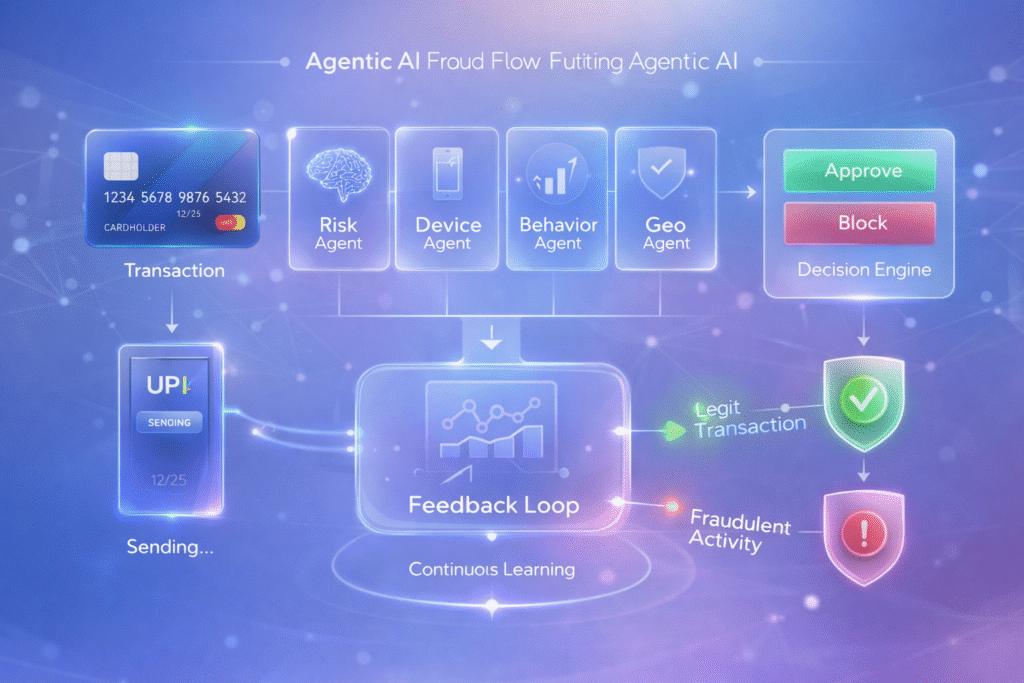

⚙️Step-by-Step Sequence

| 1. Transaction Initiated |

| Card, UPI, wallet, or BNPL payment starts |

| 2. AI Agents Activate |

| Risk Agent |

| Behavior Agent |

| Device Agent |

| Network Agent |

| Compliance Agent |

| 3. Real-Time Data Analysis |

| User history |

| Device fingerprint |

| Location mismatch |

| Velocity checks |

| Merchant risk score |

| 4. Autonomous Decision |

| Approve instantly |

| Trigger step-up authentication |

| Block and alert |

| 5. Continuous Learning |

| Feedback loop improves future decisions |

⏱️ All of this happens in under 300 milliseconds

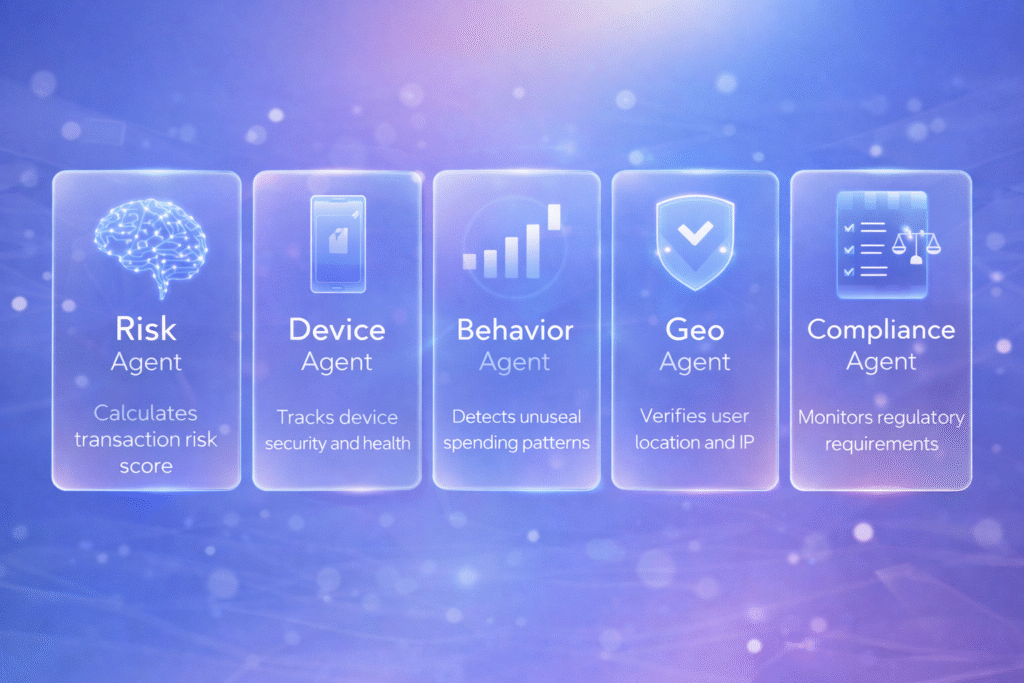

📊 Key AI Agents Used in Payment Fraud Systems

🧠 Risk Assessment Agent

- Calculates transaction risk score

- Uses ML + behavioral analytics

📱 Device Intelligence Agent

- Tracks device ID, OS, emulator detection

- Flags jailbroken or rooted devices

🔍 Behavioral Pattern Agent

- Detects unusual spending patterns

- Identifies bot-like activity

🌍 Geo-Location Agent

- Compares IP, GPS, merchant location

- Detects impossible travel patterns

⚖️ Compliance & AML Agent

- Ensures regulatory alignment

- Flags suspicious transactions for reporting

💡 Benefits of Agentic AI in Payment Fraud Prevention

🚀 1. Real-Time Protection

No delays. Fraud is stopped before money leaves the account.

🎯 2. Fewer False Positives

Legitimate customers face fewer declines → better UX.

📈 3. Scales Automatically

Handles millions of transactions without manual tuning.

🔄 4. Continuous Self-Learning

Adapts to new fraud patterns without rewriting rules.

💰 5. Cost Reduction

- Lower chargebacks

- Reduced manual reviews

- Fewer customer complaints

📊 Business Impact for Banks & Fintechs

| Area | Impact |

| Customer Trust | ↑ Higher |

| Fraud Losses | ↓ 40–70% |

| Transaction Approval Rate | ↑ 5–10% |

| Compliance Risk | ↓ Significantly |

| Operational Cost | ↓ Major savings |

⚙️ Reference Architecture (Payment Domain)

🧩 Architecture Layers

- Transaction Layer

- Cards, UPI, wallets, POS

- Data Ingestion Layer

- Kafka, APIs, event streams

- Agentic AI Layer

- Multiple AI agents (risk, behavior, device)

- Decision Engine

- Approve / Challenge / Block

- Learning & Feedback Loop

- Model retraining

- Reinforcement learning

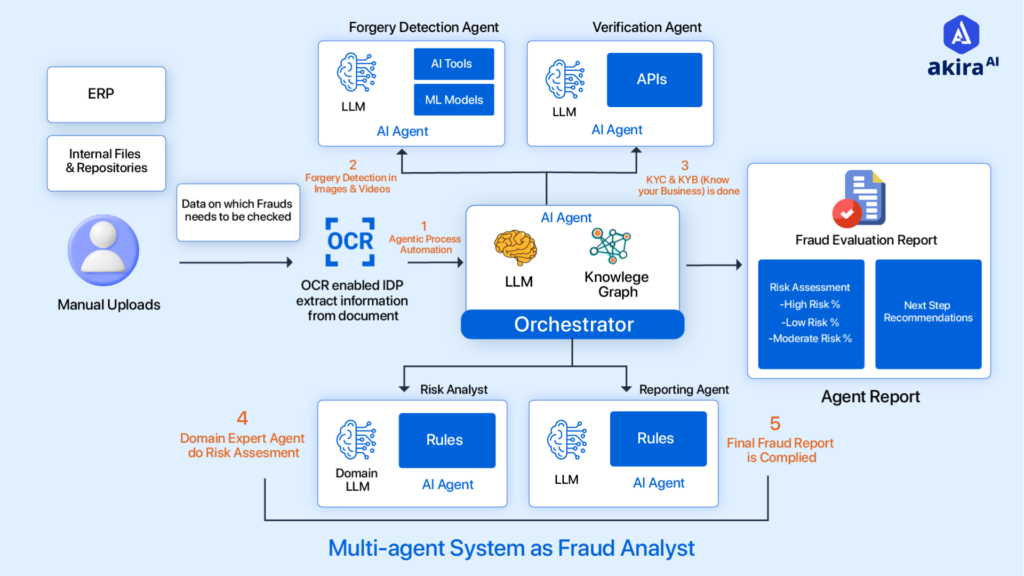

🧠 Role of LLMs in Agentic Fraud Systems

Large Language Models (LLMs) add:

- Explainable decisions

- Fraud reasoning summaries

- Investigator support

- Natural-language alerts

Example:

“Transaction blocked due to unusual merchant behavior combined with new device and location mismatch.” This improves trust and auditability

🌍 Real-World Use Cases (2025)

- UPI fraud prevention in India

- Card fraud detection for global payment gateways

- BNPL risk scoring

- Merchant onboarding fraud

- Cross-border payment security

📈 Future Trends in Agentic AI for Payments

🔮 What’s Coming Next?

- Self-negotiating AI agents between banks and merchants

- Federated learning (privacy-first fraud detection)

- AI-driven regulatory reporting

- Voice & biometric fraud agents

- Autonomous chargeback handling

By 2027, most payment fraud systems will be fully agent-driven

🏁 Conclusion: The Future of Payment Security Is Autonomous

Agentic AI is not just an upgrade —

it’s a fundamental shift in how payment systems think and protect users.

For banks, fintechs, and payment companies, the message is clear:

Fraud prevention must be real-time, intelligent, and autonomous.

And Agentic AI is the technology making that possible. If you found this useful, share it, bookmark it, or drop a comment — because the future of payments is being built right now