Agentic AI is transforming trade execution and market making with adaptive, self-learning trading systems. Learn how AI improves liquidity, pricing, and efficiency.

💡How Agentic AI Is Redefining Trade Execution and Market Making

Trade execution and market making shape the heart of global finance. Whether it’s stocks, crypto, forex, commodities—or even tokenized assets—markets move because traders buy and sell continuously. But today, something groundbreaking is happening:

Agentic AI is entering the trading floor.

Unlike traditional trading algorithms that follow fixed rules, Agentic AI can think, decide, learn, negotiate, collaborate, and adapt in real time—just like a skilled human trader.

This shift is so massive that analysts believe:

“Agentic AI will become the core engine of modern markets, automating 60–80% of trade decisions by 2030.” Let’s dive into how Agentic AI is transforming trade execution and market making—and what it means for investors, institutions, exchanges, and regulators

✅ What is Agentic AI? (Simple Explanation)

Agentic AI is AI that behaves like an intelligent agent.

It doesn’t just respond to commands — it:

- Understands context

- Sets goals

- Creates strategies

- Executes actions

- Learns from outcomes

- Self-improves continuously

In trading, this means:

| Traditional Algorithm | Agentic AI |

| Follows fixed rules | Thinks, adapts, and optimizes |

| Needs manual tuning | Self-learns through feedback loops |

| Responds to events | Anticipates events before they happen |

| Good in stable markets | Designed for volatile environments |

This makes Agentic AI the next evolution of quant trading

📈 Where Agentic AI Fits in Financial Markets

Agentic AI is now being used in:

| Area | Example of Use |

| Trade Execution | Deciding when/how to execute buy/sell orders |

| Market Making | Providing liquidity & managing inventories |

| Arbitrage | Exploiting price differences across exchanges |

| Portfolio Rebalancing | Adjusting asset weights dynamically |

| Risk Management | Predicting drawdowns and volatility exposure |

💡 How Trade Execution Works (Before vs. After AI)

Before AI

A trader would:

- Observe the market

- Decide when to buy/sell

- Split orders manually

- Avoid slippage based on experience

With Agentic AI

The AI:

- Reads order books, news feeds, on-chain data

- Executes smart order routing across multiple venues

- Minimizes slippage automatically

- Times orders for best price fill

- Learns from every executed trade

🧠 How Agentic AI Market Makers Operate

Market makers provide liquidity by quoting buy (bid) and sell (ask) prices.

Agentic AI does this better by:

- Predicting near-term price movements

- Adjusting spreads dynamically

- Managing inventory automatically

- Avoiding losses during volatility spikes

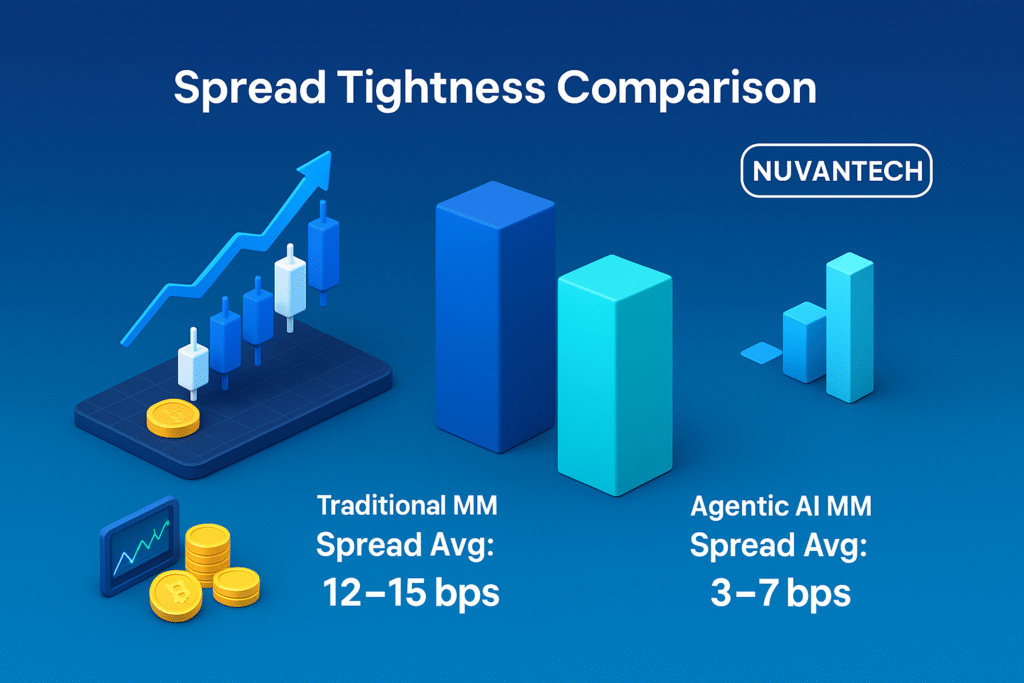

This leads to tighter spreads, better liquidity, and lower trading costs for everyone.

🧩 Core Components of an Agentic Trading System

| Component | Role |

| Market Data Layer | Reads tick-by-tick prices, depth, news, crypto mempools |

| Decision Engine (LLM + RL model) | Determines best trading strategy |

| Execution Engine | Splits and routes orders |

| Risk Engine | Monitors portfolio exposure and drawdown |

| Feedback Loop | Learns from outcomes to self-improve |

🛠️ Step-by-Step Workflow of Agentic AI in Trade Execution

- Ingest Data (Price, liquidity, volatility, sentiment)

- Predict Short-Term Market Direction

- Determine Desired Trade Size

- Select Execution Strategy (TWAP, VWAP, Sniper, Iceberg, Dark Pools)

- Place Smart Routed Orders

- Monitor Fill Status and Market Conditions

- Adjust Orders Dynamically

- Record Outcome for Self-Improvement

⭐ 6 Benefits of Agentic AI in Market Making and Execution

| Benefit | Explanation |

| Better Pricing | AI narrows bid-ask spreads intelligently |

| Lower Slippage | Smarter order timing & routing |

| Higher Liquidity | AI provides liquidity even in volatility |

| Faster Reaction Time | Microsecond trade execution |

| Reduced Human Bias | No emotional trading mistakes |

| Scalable Across Markets | AI can run 24/7 globally |

📊 Example Visualization: AI-Based Vs Traditional Market Maker

🚀 Real-World Use Cases in 2025

| Company | How They Use AI |

| Citadel Securities | Ultra-low-latency AI execution |

| Jump Trading | Machine learning-driven crypto market making |

| Jane Street | AI-based arbitrage and ETF pricing |

| Binance & Coinbase Pro | AI liquidity bots managing order books |

| Uniswap v4 & Curve | On-chain automated market making (AMMs) with reinforcement agents |

🔮 Future Trends (2025–2030)

- Fully autonomous trading desks

- Agent-to-Agent market negotiation

- Decentralized AI market makers on-chain

- 24/7 cross-asset execution systems

- Regulated AI market governance frameworks

⚠️ Risks & Challenges

| Risk | Impact |

| Flash Crashes | AI reacting too quickly to noise |

| AI Collusion | Agents unintentionally coordinating prices |

| Regulatory Gaps | Laws not yet adapted for AI decision-making |

| Model Bias | Incorrect predictions under rare events |

Regulators are working on AI audit trail and explainability frameworks.

🎯 Conclusion — The Market Is Changing Fast

Agentic AI isn’t just making trading faster—

it is fundamentally changing how markets operate.

From hedge funds to crypto exchanges to retail brokers, everyone is rapidly integrating AI to:

- Improve liquidity

- Optimize trade execution

- Reduce risk

- Increase profitability

The future of markets is:

AI-driven, self-learning, globally connected, and continuously adaptive.

If you’re an investor, trader, or fintech builder — this is the moment to learn and adapt.