Agentic AI in WealthTech explained: how data pipelines power goal-based advice engines, automated portfolios, and the future of intelligent financial planning

Imagine a financial advisor who never sleeps, constantly learns from new data, and adjusts your investment strategy automatically as your life changes. That’s the promise of Agentic AI in WealthTech—a new generation of intelligent systems that move beyond simple automation and act as proactive, goal-driven financial assistants.

Instead of just analyzing data, agentic AI systems can plan, decide, and execute actions on behalf of investors or advisors. From building personalized portfolios to monitoring risks in real time, these AI “agents” are transforming the way financial advice is delivered.

In this article, we’ll break down what agentic AI means, how it works in wealth management, and how it’s shaping the future of financial advice.

🧠 What Is Agentic AI in WealthTech?

Agentic AI refers to artificial intelligence systems that can:

- Understand goals

- Plan actions

- Make decisions

- Execute tasks

- Learn from outcomes

In the context of wealth management, these systems act like digital financial advisors—but with continuous monitoring, instant response, and data-driven intelligence.

Traditional AI vs Agentic AI

| Traditional AI | Agentic AI |

| Analyzes data | Sets goals and executes strategies |

| Responds to queries | Proactively takes action |

| Rule-based automation | Autonomous decision-making |

| Static recommendations | Dynamic, adaptive advice |

Simple example:

- Traditional AI: “Your portfolio risk is high.”

Agentic AI:

“Your portfolio risk is high. I’ve rebalanced 5% from equities to bonds to align with your retirement goal.”

📊 Why WealthTech Needs Agentic AI

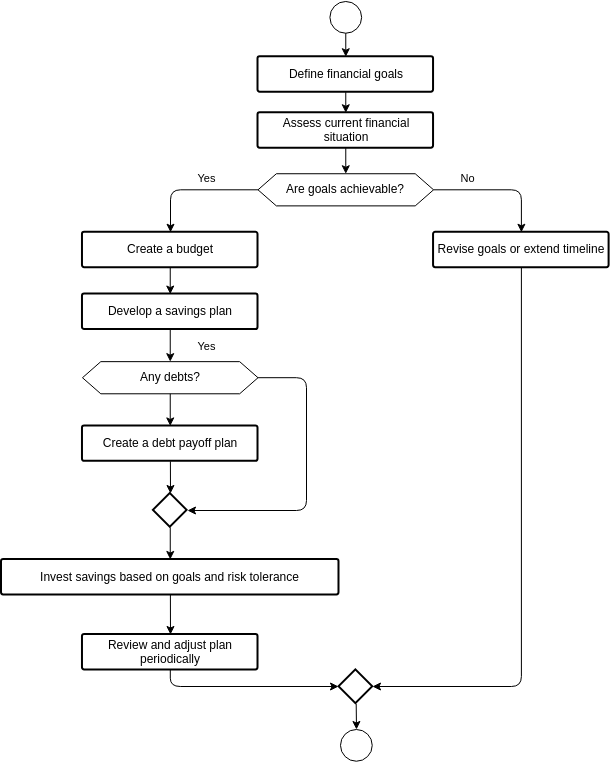

Financial planning isn’t a one-time activity. It’s a continuous process involving:

- Market changes

- Life events

- Tax rules

- Cash-flow shifts

- Goal updates

Humans can’t monitor everything 24/7. Agentic AI fills that gap.

Key Benefits

📈 1. Real-Time Portfolio Adjustments

AI agents can:

- Monitor markets continuously

- Rebalance portfolios automatically

- Adjust allocations based on goals

💡 2. Hyper-Personalized Advice

Instead of generic recommendations, agentic systems:

- Analyze spending behavior

- Track life goals

- Adapt strategies dynamically

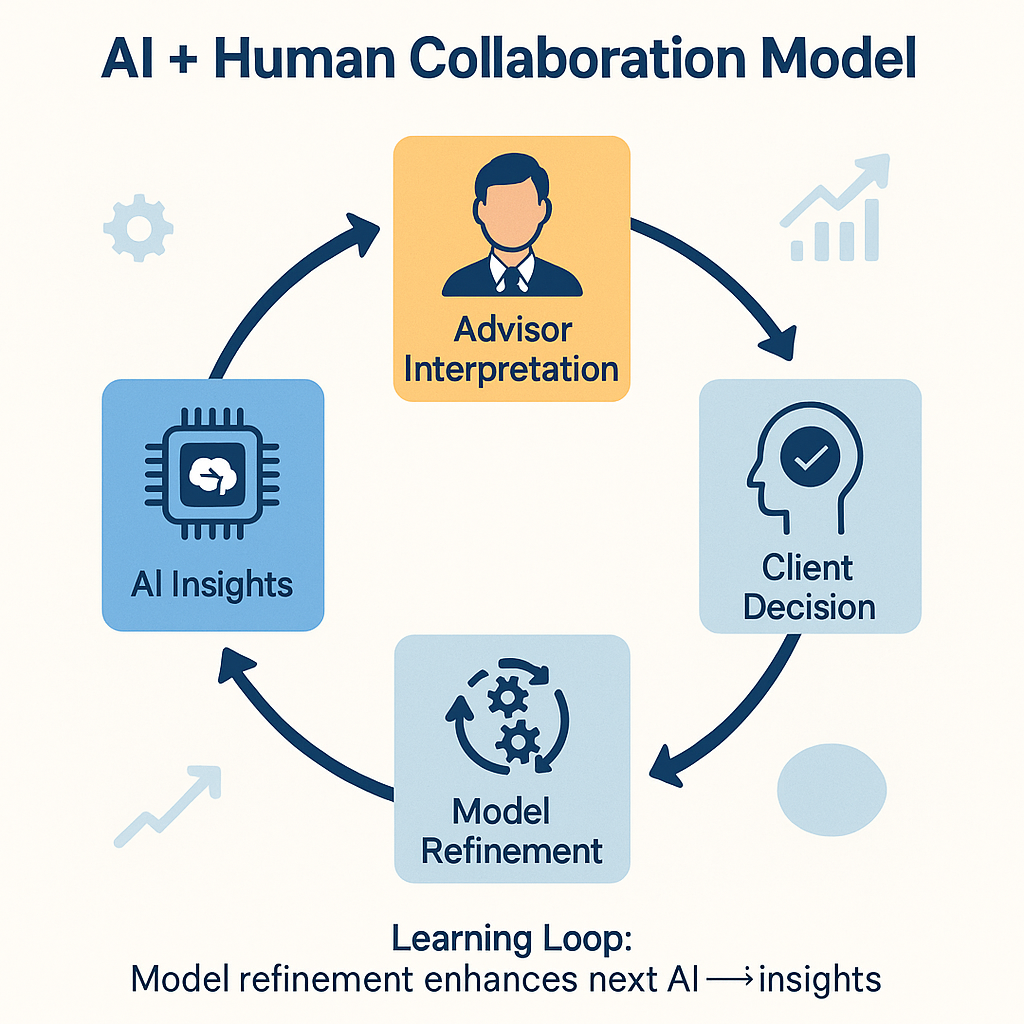

⚙️ 3. Operational Efficiency for Advisors

Advisors can automate:

- Portfolio reviews

- Risk alerts

- Client reporting

- Tax optimization

🌍 4. Scalable Advice for Millions

Agentic AI makes goal-based advice affordable for:

- Young investors

- Mass-affluent clients

- Emerging markets

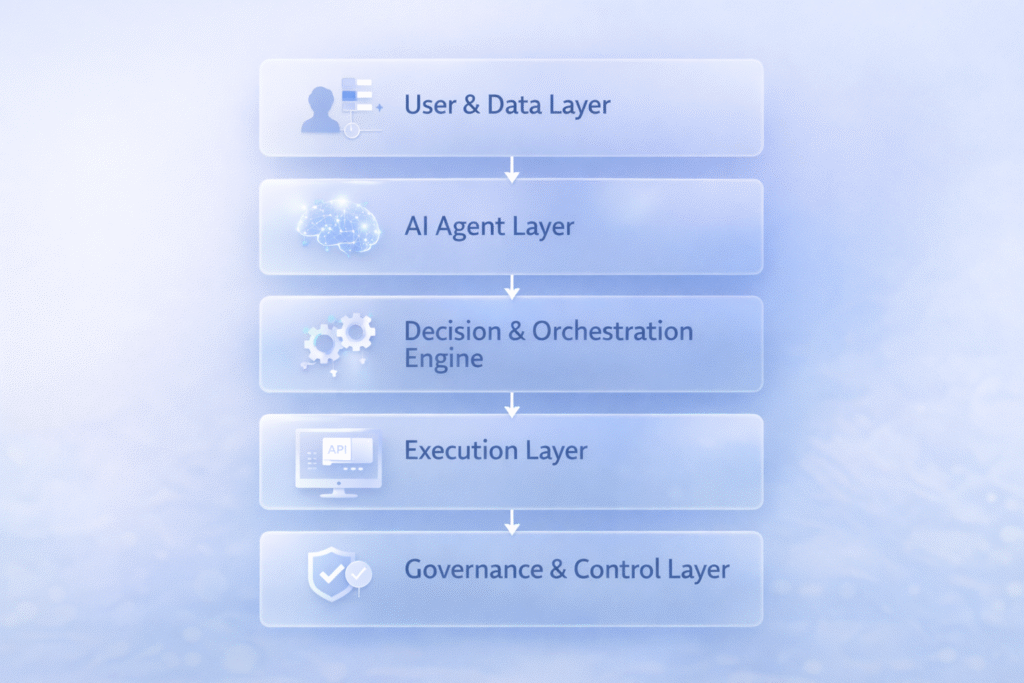

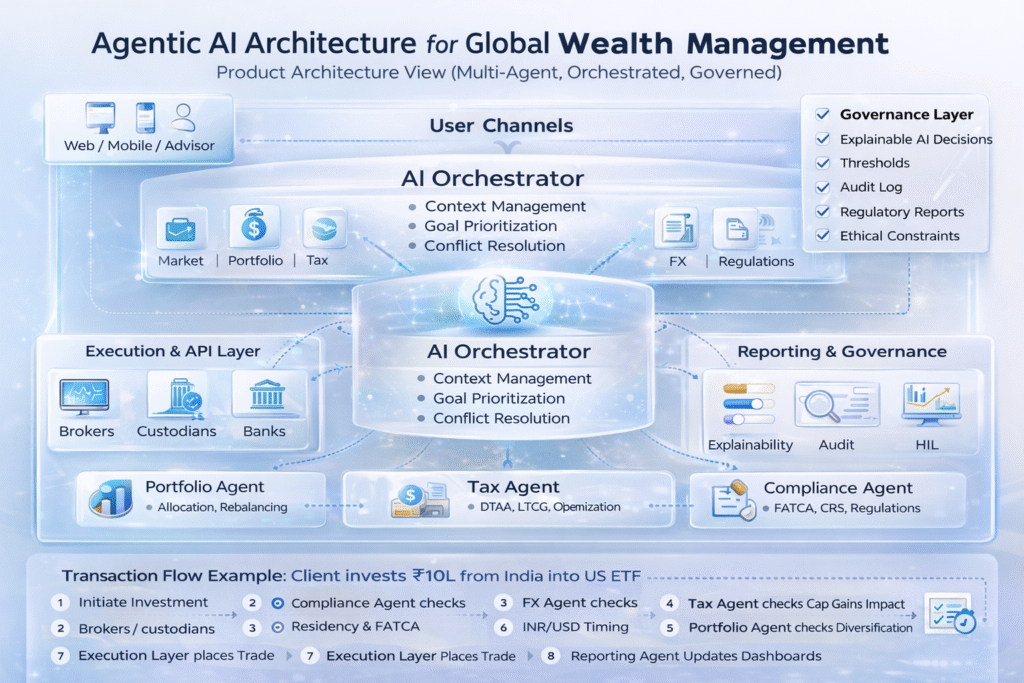

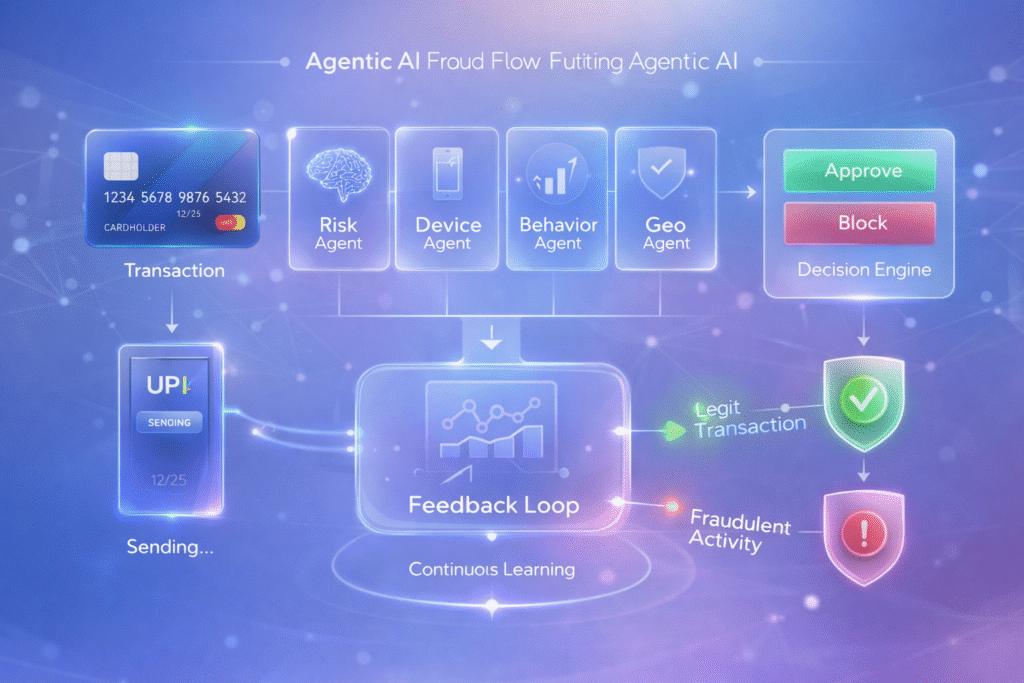

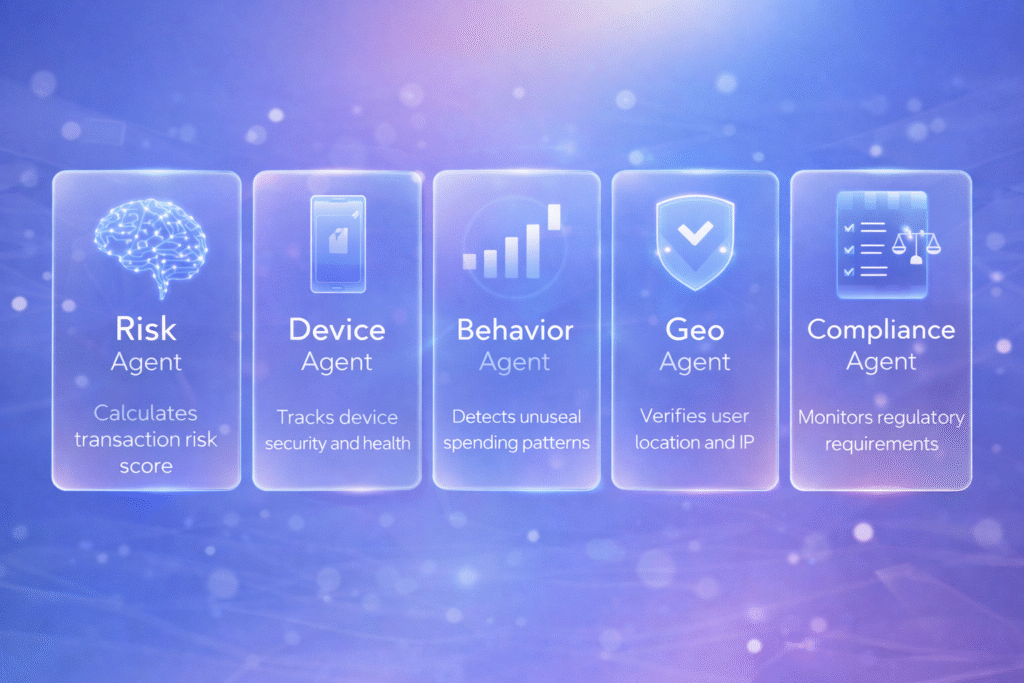

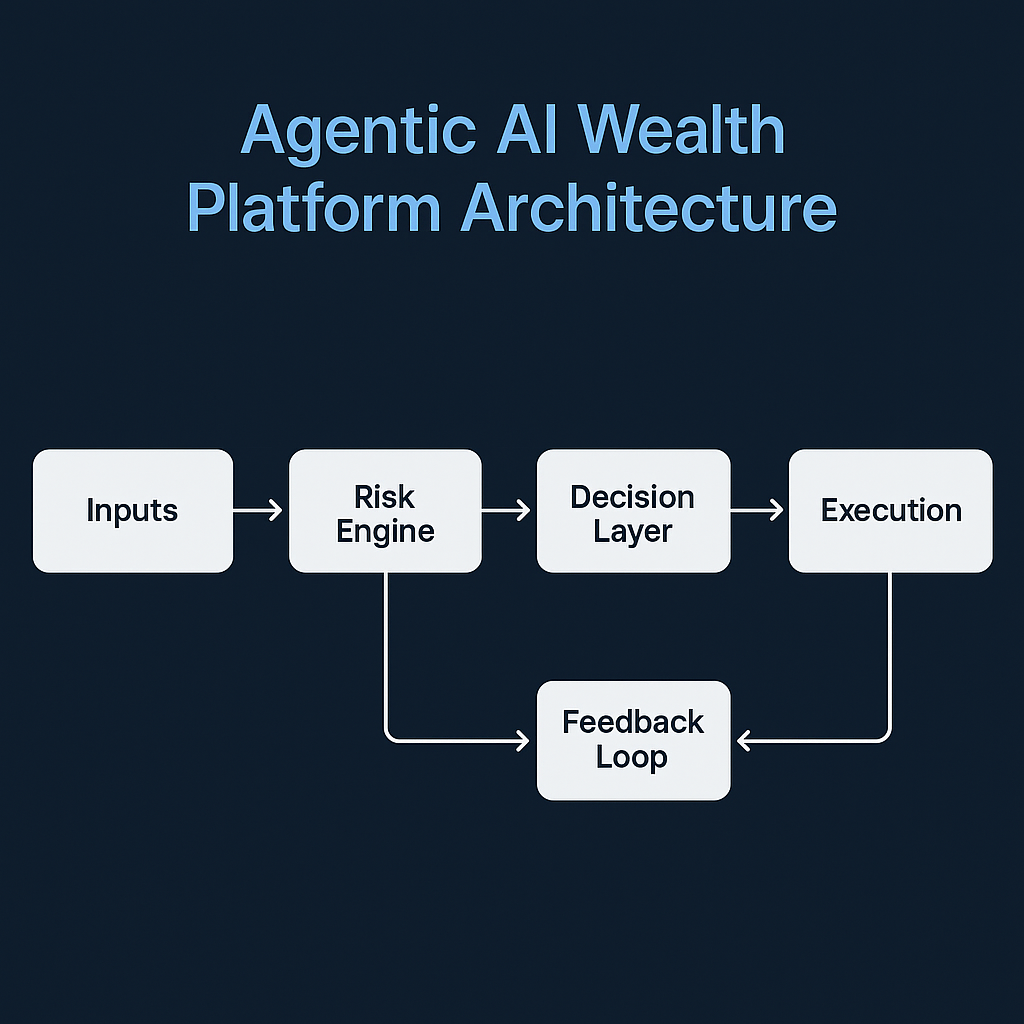

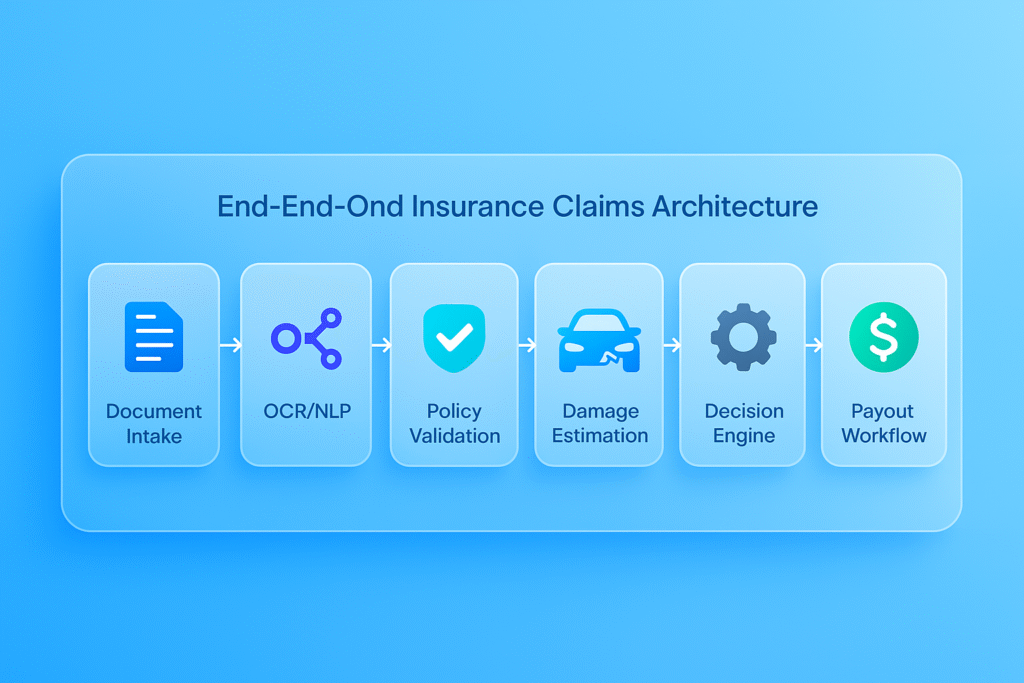

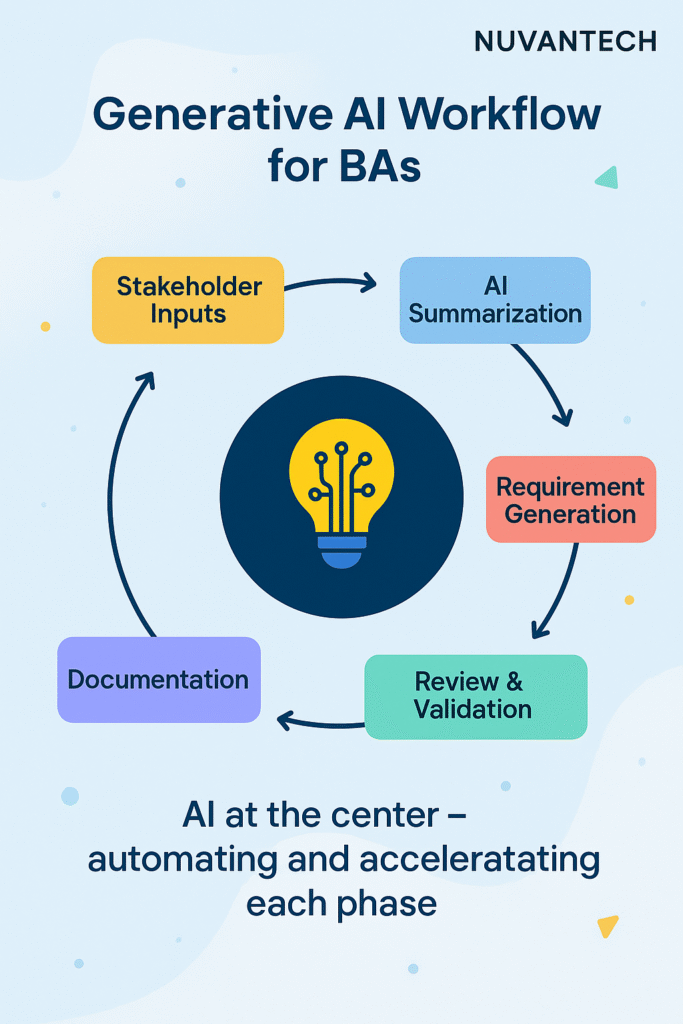

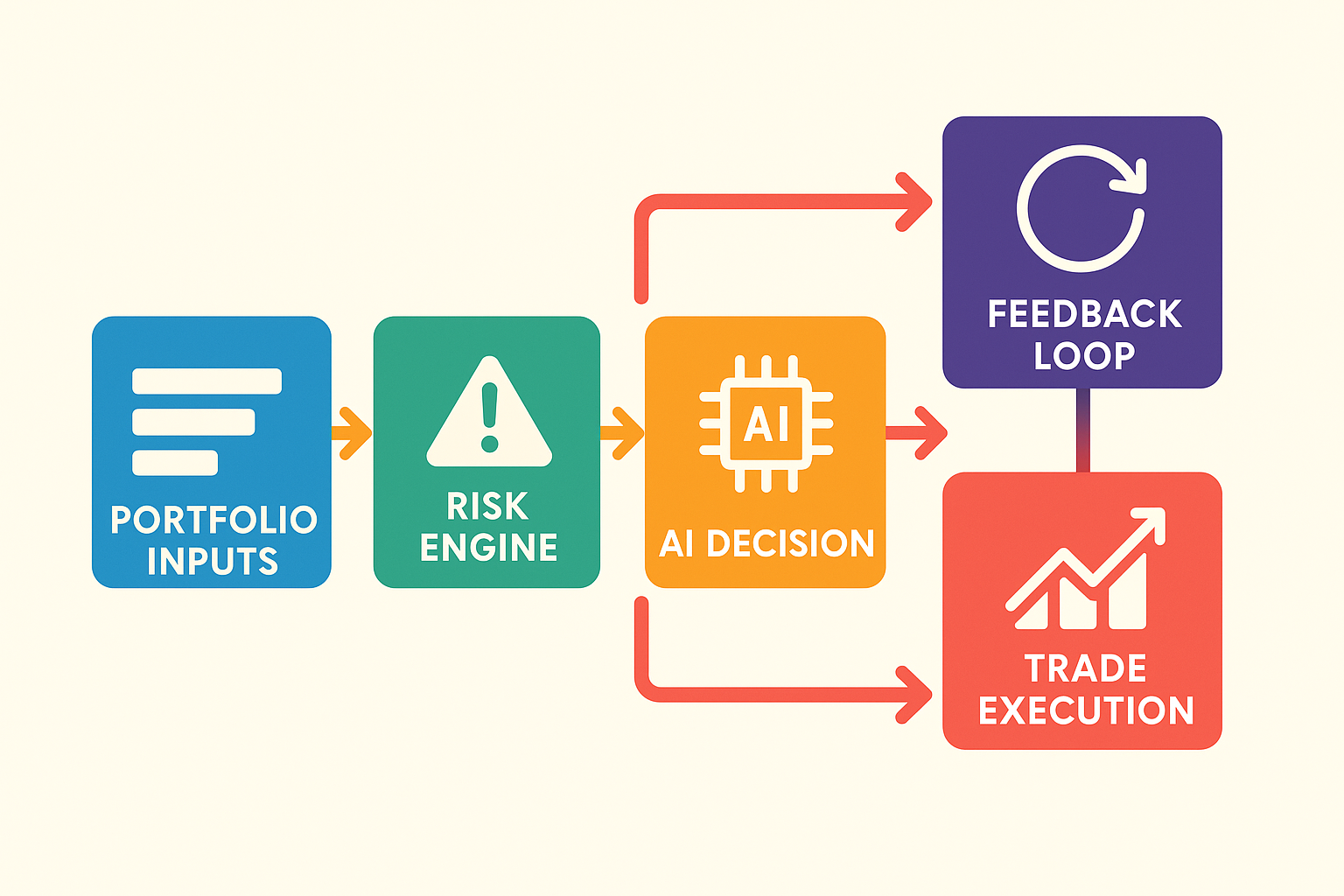

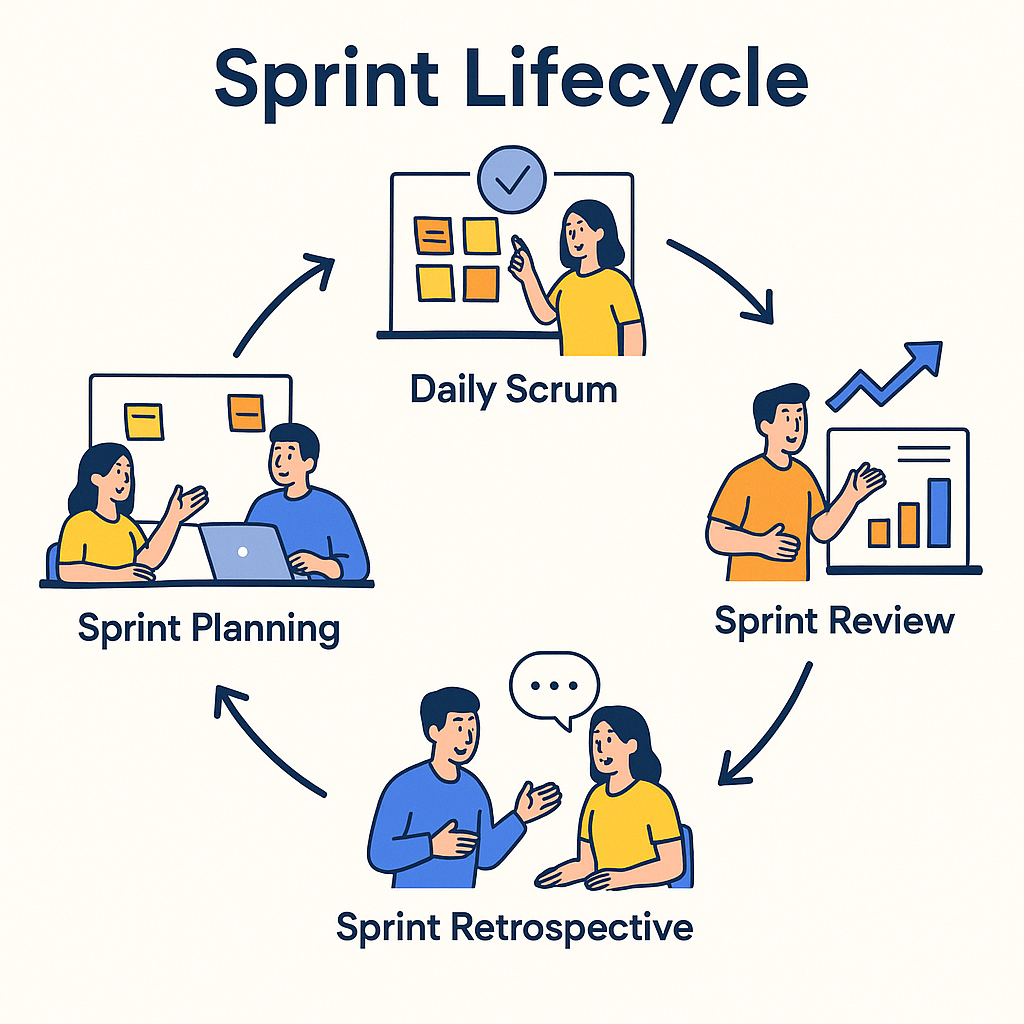

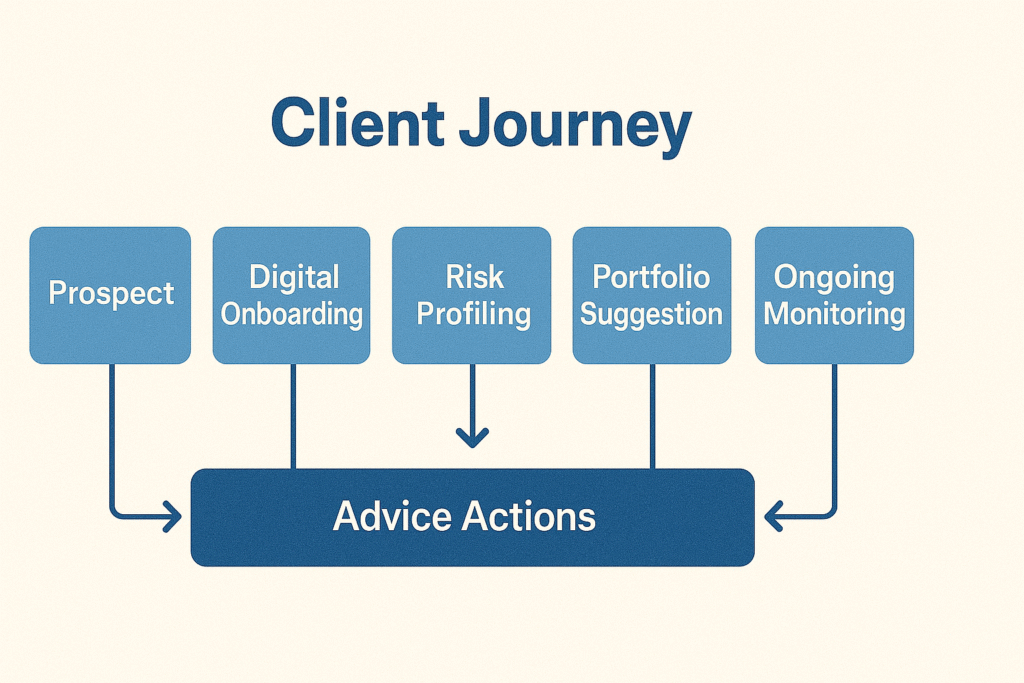

📲Core Components of an Agentic WealthTech System

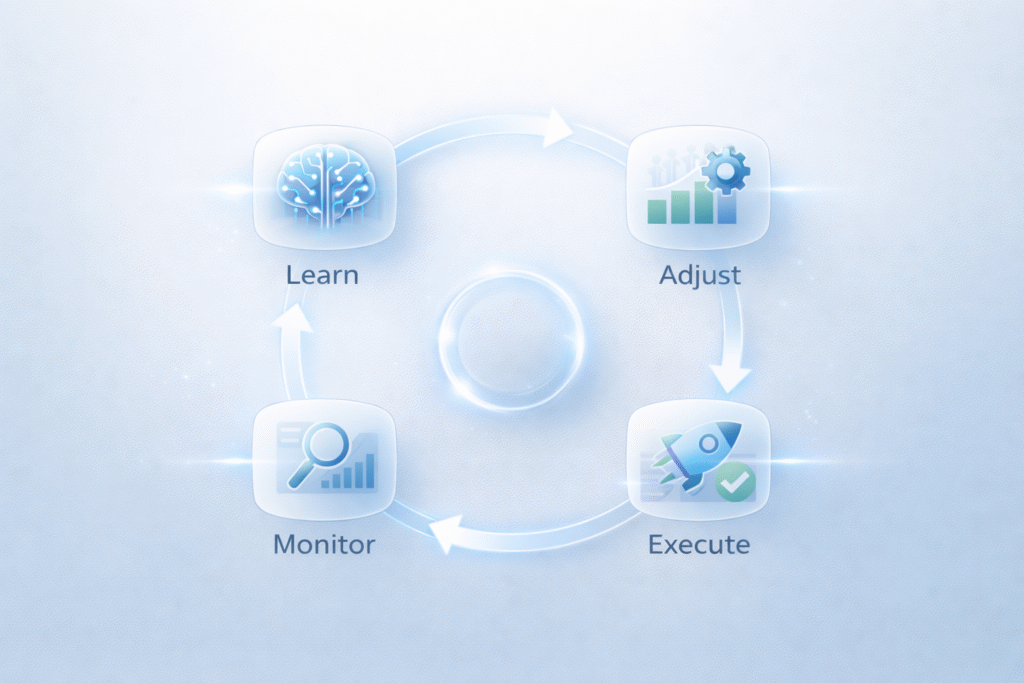

An agentic wealth platform typically follows a structured sequence

Step-by-Step Flow

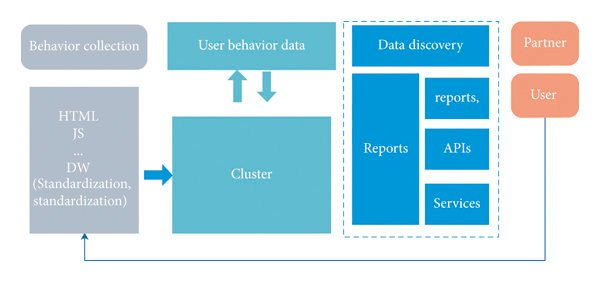

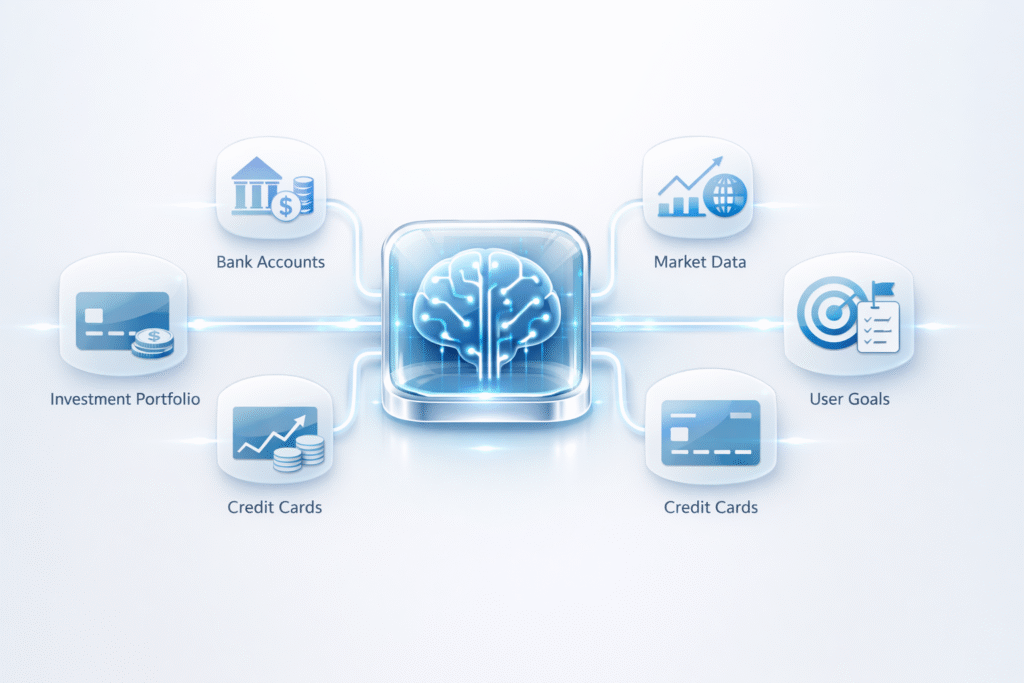

1. 📥 Data Ingestion Layer

Collects financial and behavioral data from:

- Bank accounts

- Investment portfolios

- Credit cards

- Market feeds

- User goals

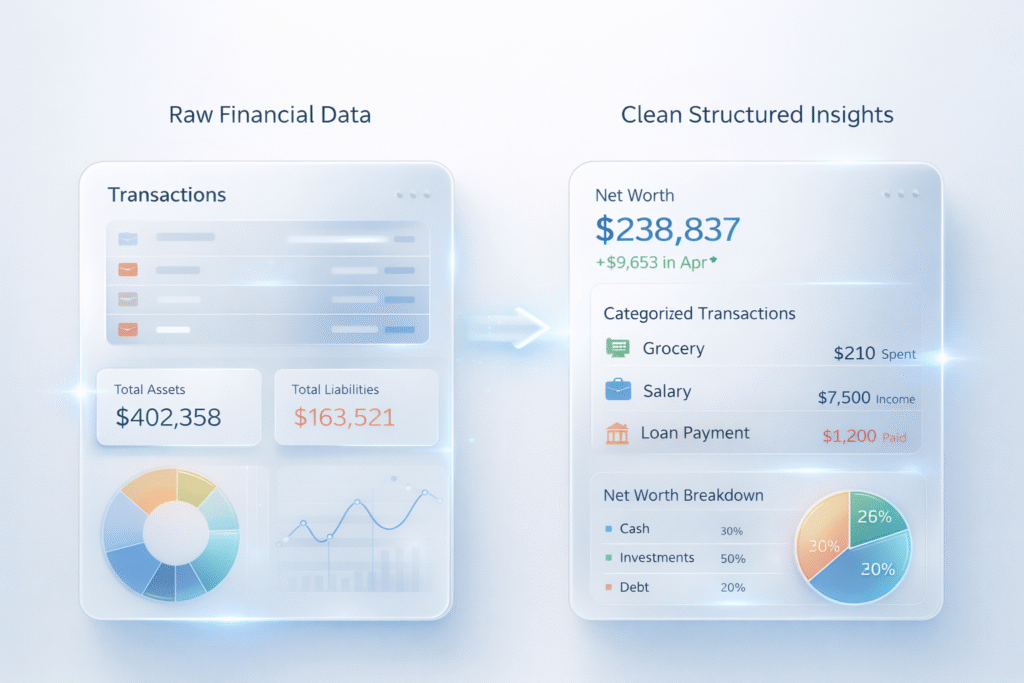

2. 🧹 Data Processing & Enrichment

The system:

- Cleans raw data

- Categorizes transactions

- Calculates net worth

- Identifies patterns

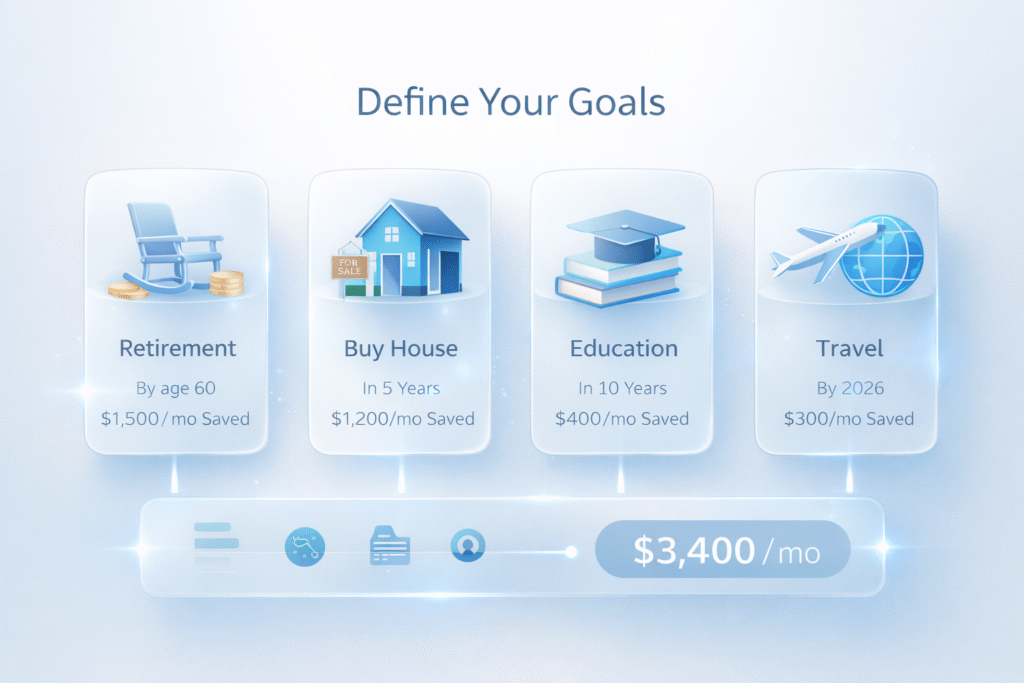

3. 🎯 Goal Definition Engine

Users define financial goals such as:

- Retirement at age 60

- Buying a home in 5 years

- Child education fund

- Early financial independence

The AI converts these into:

- Target corpus

- Time horizon

- Risk tolerance

- Monthly investment plan

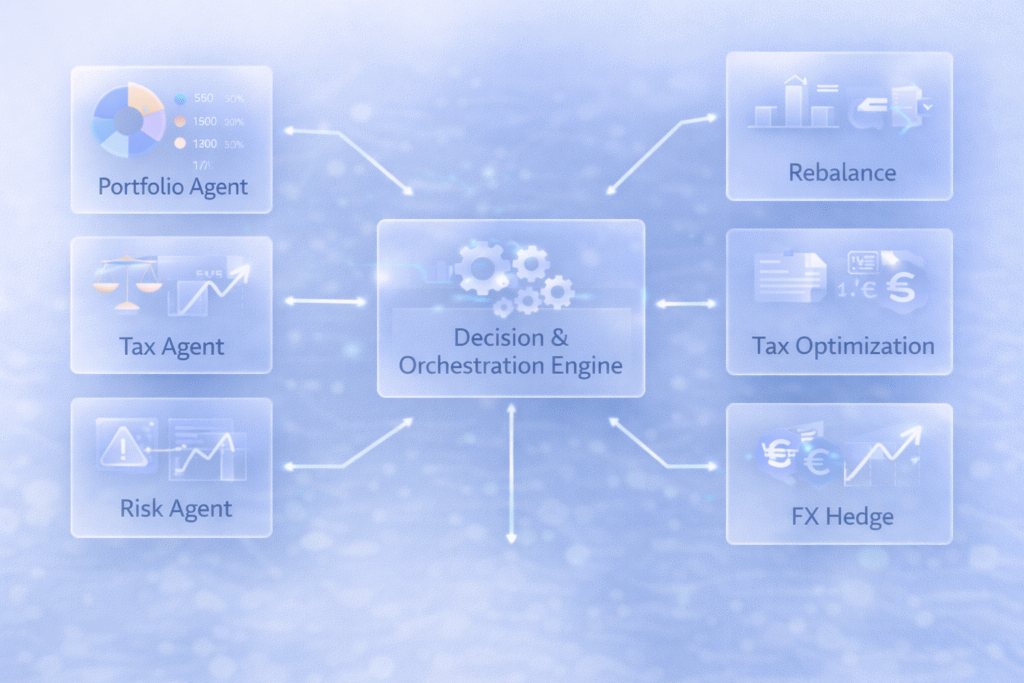

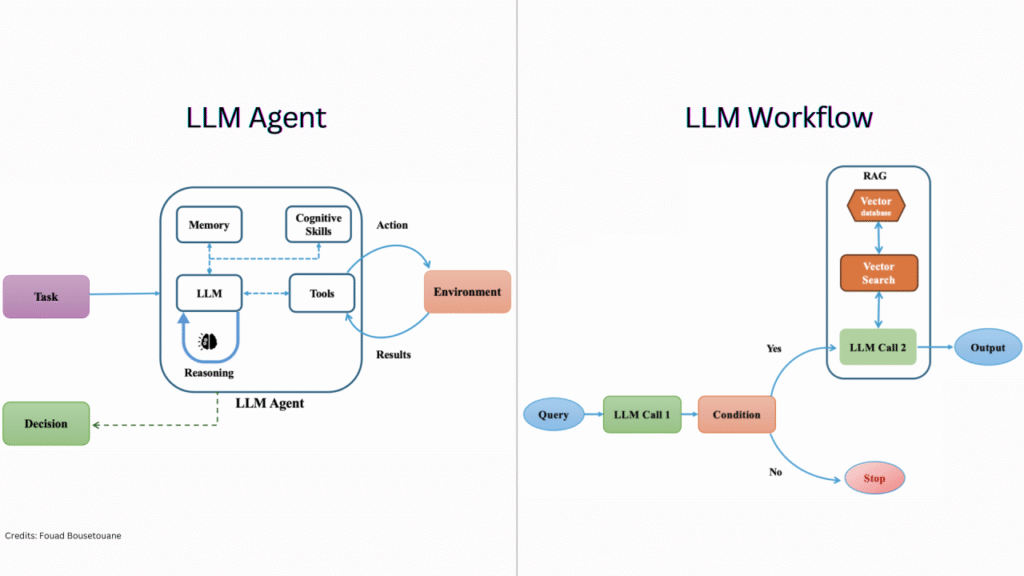

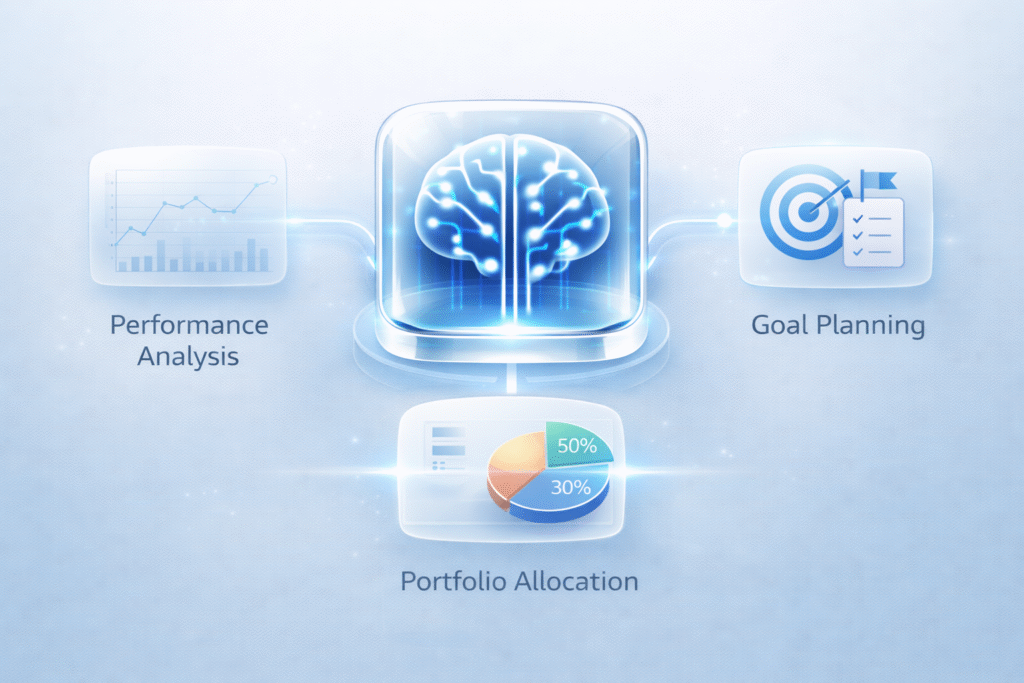

4. 🧠 Decision & Strategy Engine

This is the brain of the agentic system.

It:

- Evaluates current portfolio

- Compares it with goal requirements

- Suggests allocation changes

- Plans rebalancing or tax actions

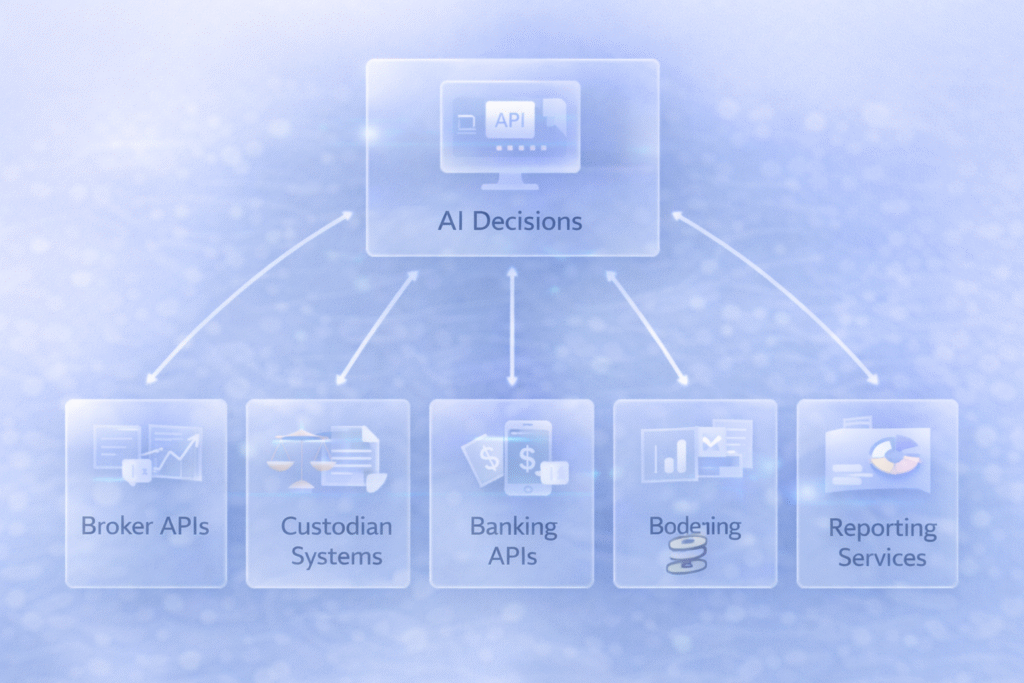

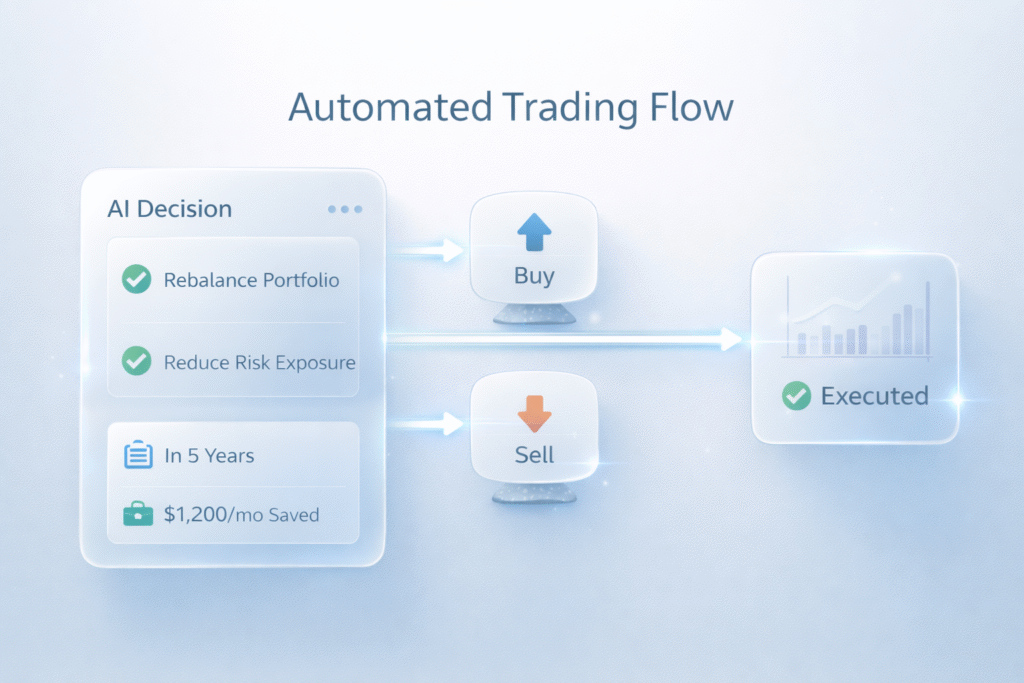

5. ⚙️ Execution Layer

Once decisions are made, the agent:

- Rebalances portfolios

- Places trades

- Adjusts SIP amounts

Sends alerts to users or advisors

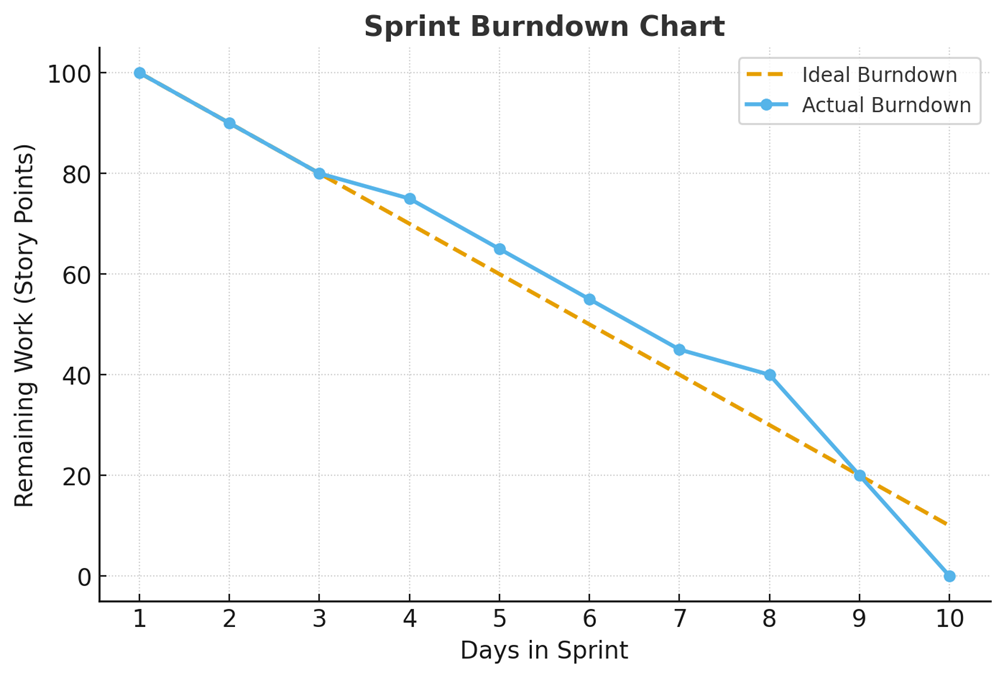

6. 🔁 Continuous Feedback Loop

The AI constantly learns from:

- Market changes

- User behavior

- Goal updates

- Performance outcomes

This creates a self-improving advice engine.

📲 Real-World Use Cases of Agentic AI in WealthTech

1. Automated Retirement Planning

AI tracks:

- Salary changes

- Inflation

- Market performance

Then automatically:

- Increases contributions

- Adjusts asset allocation

2. Smart Tax Optimization

Agentic AI can:

- Harvest tax losses

- Optimize withdrawals

- Suggest tax-efficient funds

3. Cash-Flow-Based Investing

Instead of fixed SIPs:

- AI tracks expenses

- Detects surplus cash

- Invests automatically

4. Behavioral Coaching

AI agents can:

- Detect panic selling

- Send calming messages

- Suggest long-term strategies

📈 Benefits for Investors and Advisors

For Investors

- 24/7 portfolio monitoring

- Personalized strategies

- Faster decision-making

- Lower advisory costs

For Financial Advisors

- Automation of routine tasks

- Better client insights

- Scalable service models

- More time for relationship building

🧭 How to Build an Agentic WealthTech Platform (Step-by-Step)

Step 1: Define Core Goals

Start with:

- Retirement planning

- Tax optimization

- Risk management

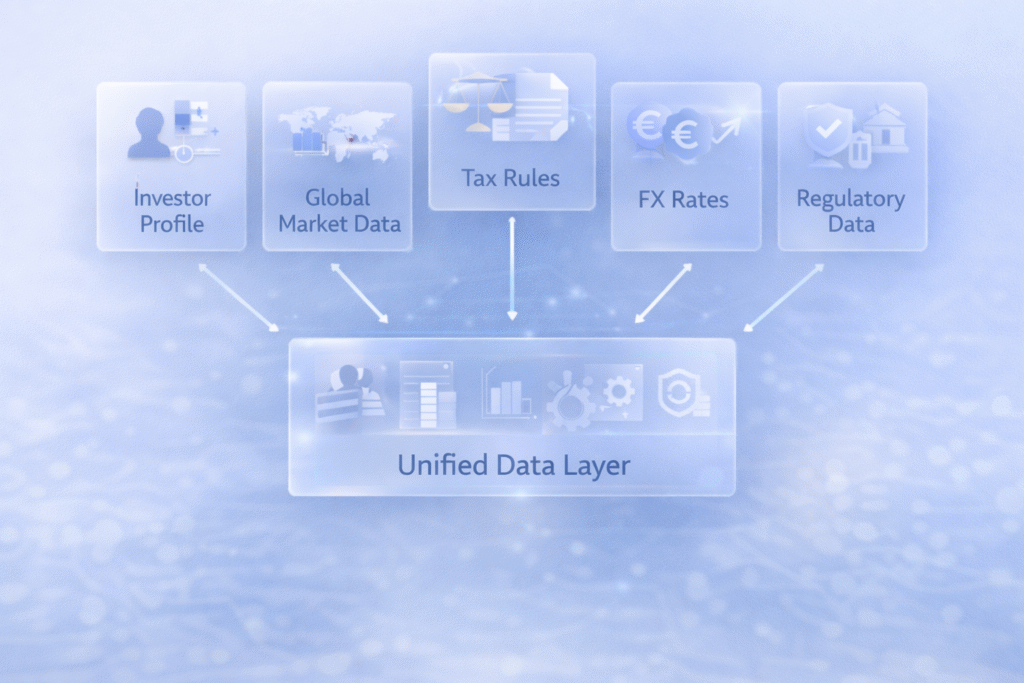

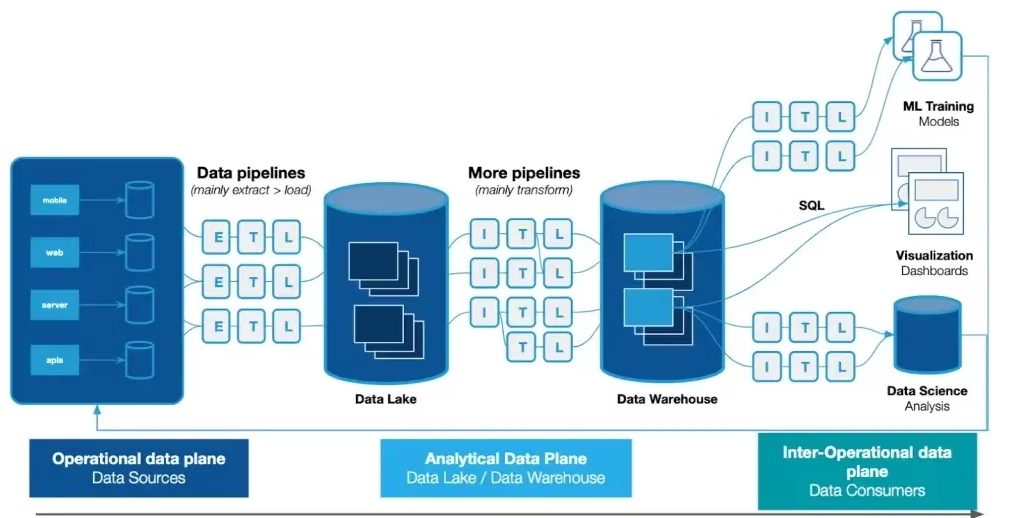

Step 2: Build the Data Foundation

Integrate:

- Bank APIs

- Portfolio feeds

- Market data

- User profiles

Step 3: Develop the AI Decision Engine

Use:

- Machine learning models

- Portfolio optimization algorithms

- Scenario simulations

Step 4: Create the Execution Layer

Enable:

- Automated rebalancing

- Trade execution

- Alert systems

Step 5: Add Feedback & Learning Loops

Implement:

- Performance tracking

- Behavioral analytics

- Strategy refinement

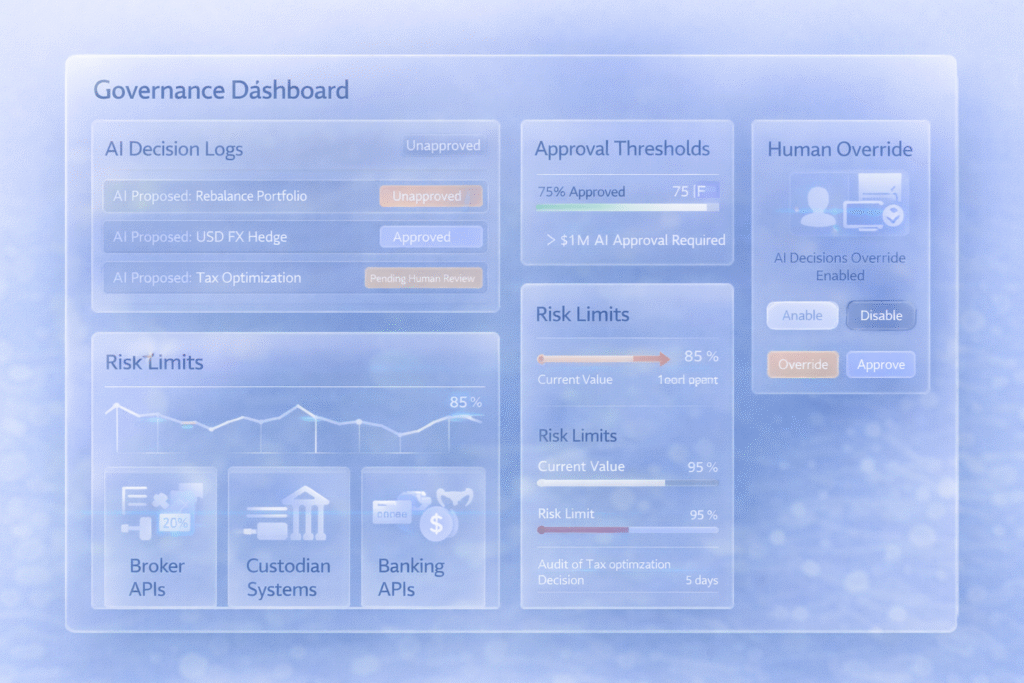

⚠️ Challenges and Risks

Even though agentic AI is powerful, there are some concerns.

Key Challenges

- Regulatory compliance

- Data privacy

- Model bias

- Over-automation risks

- Client trust

How Firms Can Mitigate Risks

- Human oversight

- Transparent algorithms

- Regular audits

- Explainable AI systems

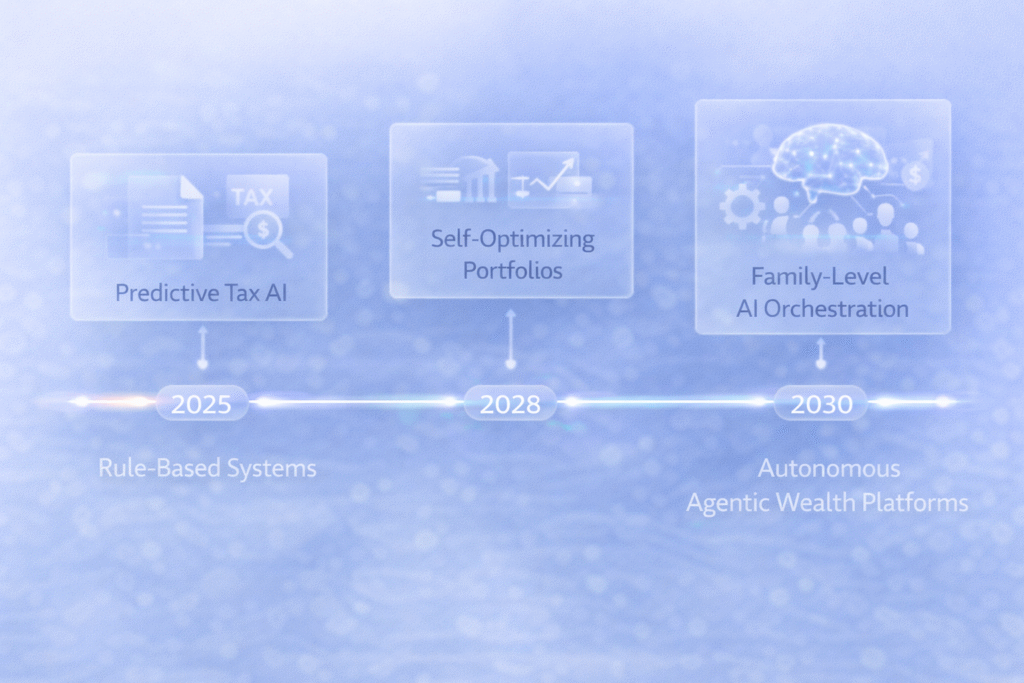

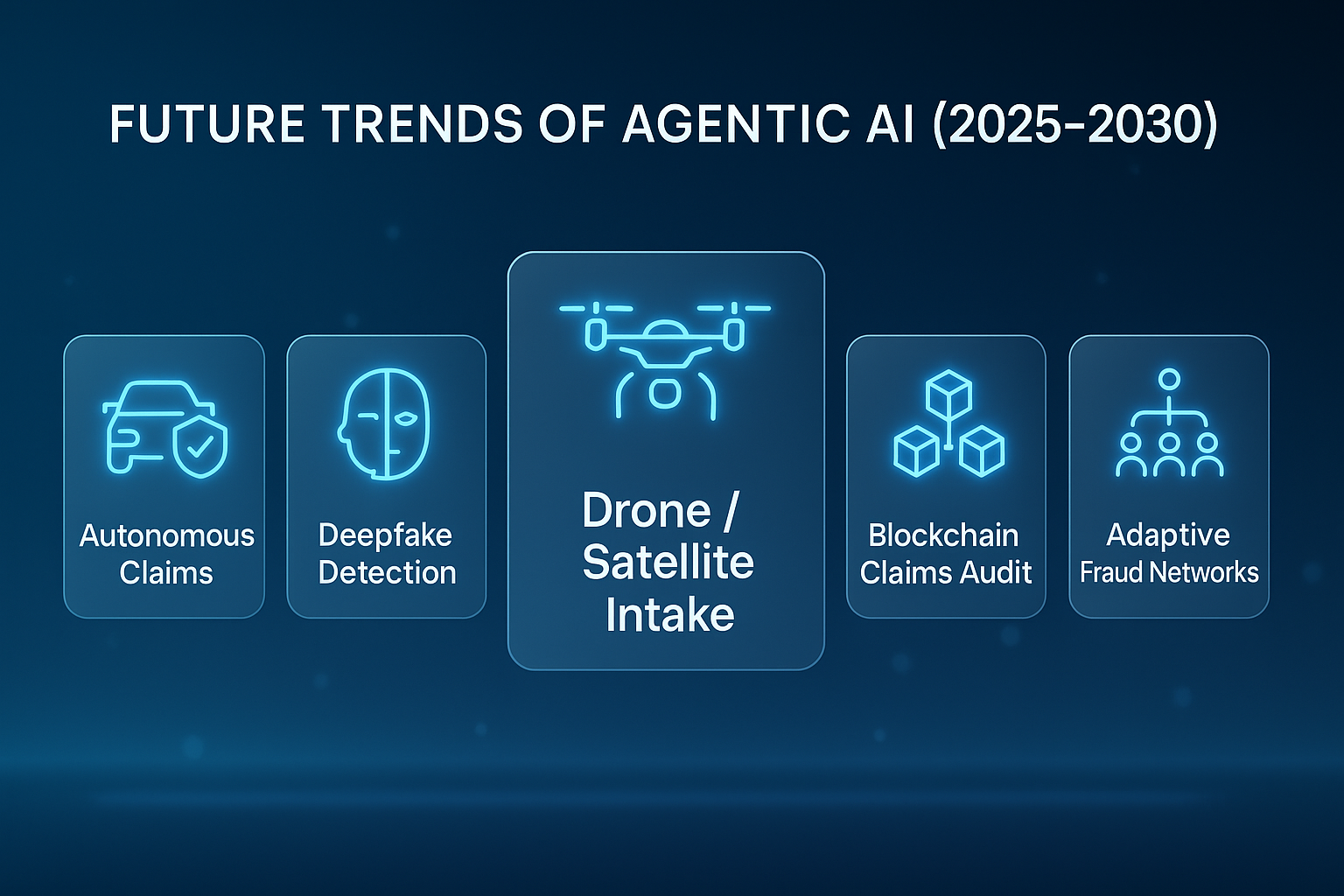

🌍 Future Trends in Agentic WealthTech

1. Fully Autonomous Financial Advisors

AI agents that:

Manage entire financial lives

Coordinate insurance, investments, and taxes

2. Voice-Based Financial Planning

Users will say:

“Can I retire at 55?”

And the AI will instantly simulate scenarios.

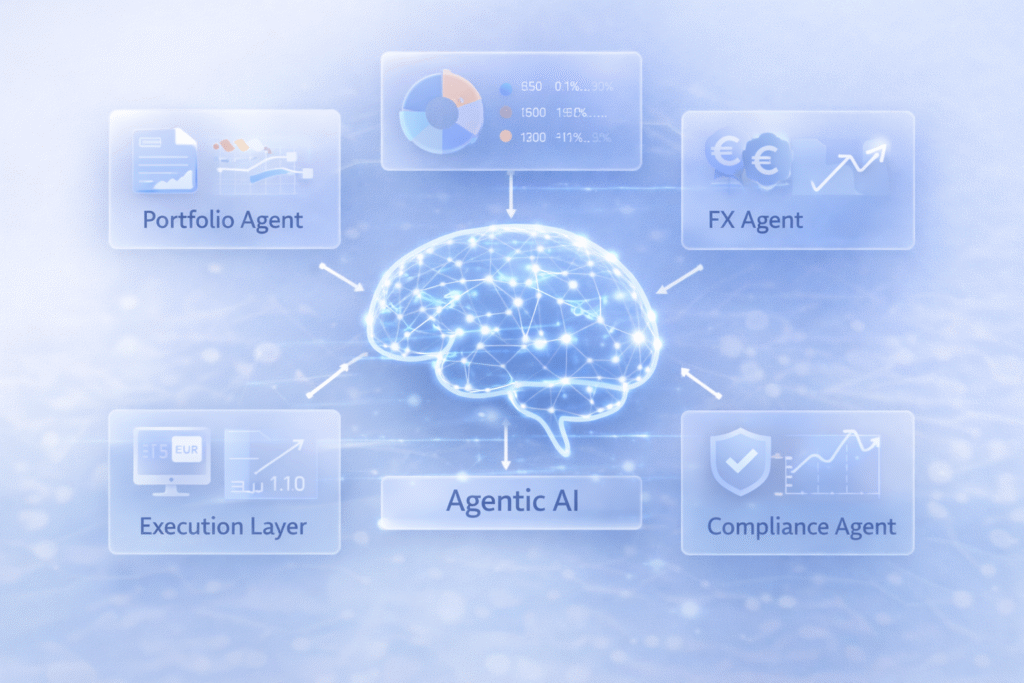

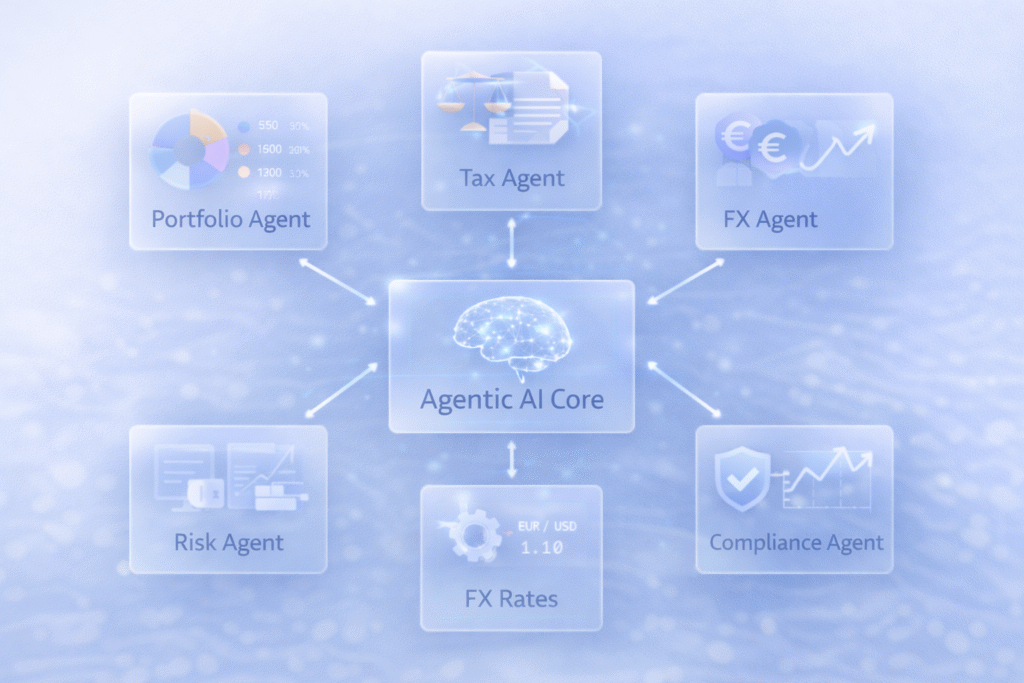

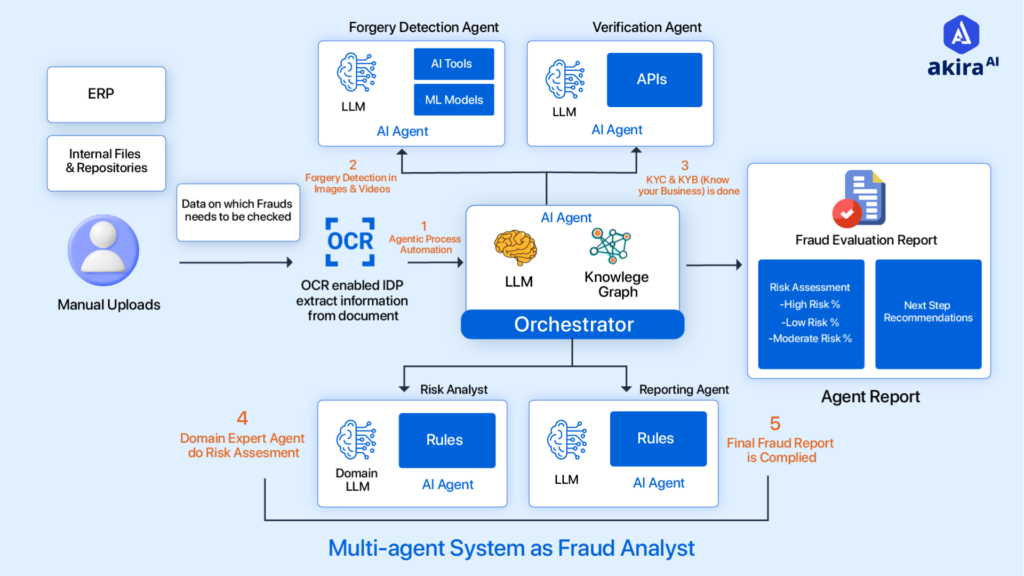

3. Multi-Agent Financial Systems

Different AI agents will handle:

Investments

Taxes

Insurance

Estate planning

All working together.

4. Real-Time Life-Event Planning

AI will detect:

Marriage

Job change

Childbirth

And automatically adjust financial plans.

🏁 Final Thoughts

Agentic AI is not just another fintech buzzword—it’s a fundamental shift in how financial advice is created and delivered.

Instead of static recommendations, we’re moving toward living, breathing financial plans that evolve with every market movement and life event.