Discover the ethics, risks, and future of AI in wealth management — learn how responsible AI, transparency, and regulation will shape the next generation of smart investing

🌍 Introduction: When AI Meets Money Management

Imagine having a financial advisor who never sleeps, tracks thousands of data points, and learns continuously from every market move.

That’s the promise of Artificial Intelligence (AI) in wealth management.

From AI chatbots giving personalized portfolio suggestions to machine learning (ML) models predicting risk and returns, AI is transforming how we build, manage, and grow wealth. But with this great power comes serious responsibility — and that’s where ethics and risk management step in. Let’s explore how AI is reshaping the financial world, the challenges it brings, and how we can ensure a responsible, transparent, and human-centered future

🧠 What Is AI in Wealth Management?

AI in wealth management refers to using machine learning, natural language processing, and predictive analytics to automate financial analysis, investment recommendations, and client interactions.

🔹 Common Applications:

- Robo-Advisors like Betterment, Wealthfront, and Schwab Intelligent Portfolios

- AI Chatbots for client onboarding and support

- Predictive Analytics for portfolio rebalancing and asset allocation

- Risk Engines for compliance and fraud detection

- Personalized Financial Planning using behavioural data

In short, AI helps advisors make smarter, faster, and more data-driven decisions — improving efficiency and client satisfaction.

⚖️ Why Ethics Matter in AI-Driven Finance

Money is emotional.

When AI starts managing wealth, it doesn’t just deal with numbers — it influences people’s futures, dreams, and financial security.

That’s why ethics must guide every decision.

Key Ethical Principles in AI for Wealth Management:

| Principle | Description | Example |

| Transparency | Clients must understand how AI makes decisions. | Explain why an algorithm suggests a certain fund. |

| Fairness | Avoid bias in AI training data. | Ensure all investors, regardless of income or geography, receive equal-quality advice. |

| Accountability | Humans remain responsible for AI-driven outcomes. | Advisors must validate and sign off major portfolio actions. |

| Privacy | Protect client financial and behavioural data. | Use encryption and anonymized data storage. |

| Explainability | AI decisions must be interpretable and auditable. | “Black box” trading models need transparent reasoning. |

⚙️ Diagram: AI Ethics Framework for Wealth Management

🚨 The Risks of AI in Wealth Management

While AI enhances productivity, it also introduces new types of financial and ethical risks.

🔻 1. Algorithmic Bias

AI learns from historical data — and if that data reflects human bias (e.g., toward certain demographics or income levels), the model might unintentionally discriminate.Example:

A risk-profiling engine may classify younger clients as “aggressive investors” simply due to age patterns in data — not individual preference

🔻 2. Lack of Explainability

Many AI models, especially deep learning systems, work like “black boxes.”

Even financial advisors can’t fully explain why the system recommended a specific investment — which poses a trust and compliance challenge

🔻 3. Data Privacy Concerns

AI-driven platforms collect sensitive financial data — spending behaviour, portfolio history, even lifestyle habits.

Without strong data governance, there’s a real risk of misuse, leaks, or unauthorized profiling.

🔻 4. Over-Reliance on Automation

When decisions are automated, human intuition may fade.

If markets shift suddenly (like during COVID-19 or geopolitical crises), AI may not fully grasp emotional market behavior — something human advisors can sense

🔻 5. Regulatory Gaps

Financial regulators are still catching up with AI innovations.

Without clear standards, companies risk violating laws on data usage, compliance, or client consent.

🌱 Benefits of Responsible AI in Wealth Management

When built ethically, AI can transform wealth management into something more accessible, transparent, and inclusive.

✅ Key Benefits:

- Efficiency: Automates repetitive tasks, allowing advisors to focus on strategy and relationship building.

- Personalization: AI learns from client data to offer customized investment recommendations.

- Accessibility: Democratizes wealth advice — even small investors can access portfolio guidance.

- Risk Mitigation: Predicts market volatility and client risk tolerance using data-driven models.

- Scalability: Handles millions of portfolios simultaneously with consistent performance

🧩 Steps for Building Ethical AI Wealth Systems

Here’s a sequence every financial firm should follow when implementing AI responsibly:

1️⃣ Ethical Design Stage

- Define clear use cases aligned with client benefit.

- Involve cross-functional teams (data scientists + compliance + advisors).

2️⃣ Data Collection & Governance

- Ensure data diversity — gender, region, income segments.

- Remove bias and ensure consent-based usage.

3️⃣ Model Testing

- Test for accuracy, fairness, and stability under multiple scenarios.

- Audit results regularly using explainable AI tools.

4️⃣ Human Oversight

- Keep advisors in the loop — AI supports, not replaces.

- Establish review protocols for critical investment decisions.

5️⃣ Continuous Monitoring

- Track AI outcomes over time.

- Feed results into a feedback loop to retrain models ethically

📊 Chart: Ethical AI Lifecycle in WealthTech

| Phase | Core Focus | Tools/Tech Used |

| Design | Define ethical goals | Governance checklist |

| Build | Train fair models | Bias detection algorithms |

| Deploy | Launch & monitor | Explainable AI dashboards |

| Review | Evaluate performance | AI audit frameworks |

| Improve | Retrain models | Continuous learning systems |

🔮 The Future of AI in Wealth Management

AI’s role in wealth management is only beginning.

In the coming years, we’ll see the rise of Agentic AI systems — self-learning financial agents capable of analyzing, executing, and optimizing portfolios autonomously.

🚀 Emerging Trends:

- Agentic AI Advisors that act independently under ethical guardrails.

- Predictive Behavioral Finance — AI reading sentiment from digital behavior.

- ESG + AI Integration — algorithms considering sustainability scores.

- Voice-based Financial Coaching powered by conversational AI.

- AI Governance Boards — firms appointing ethics committees to oversee algorithms.

⚡ The Key Takeaway:

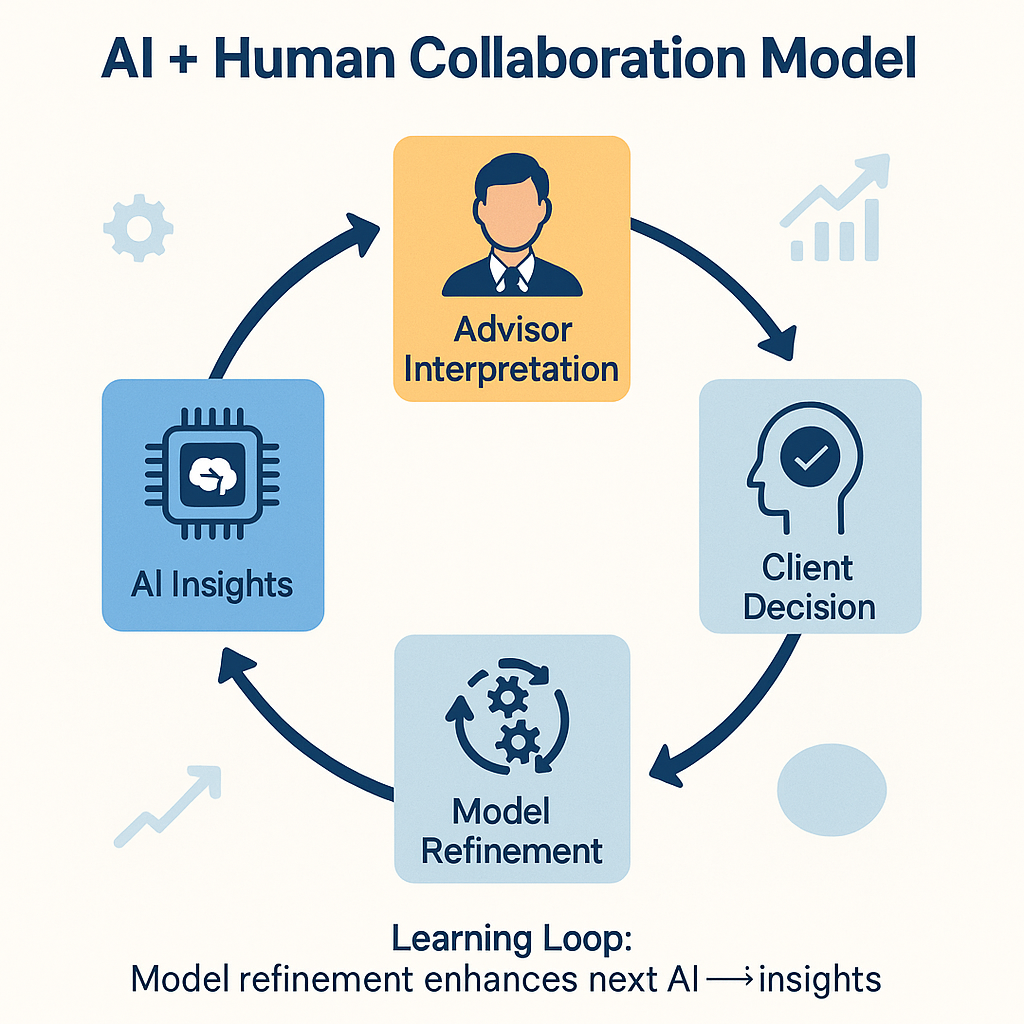

The future is not “AI vs. Advisors.”

It’s AI + Advisors — a powerful partnership where technology amplifies human empathy and judgment.

💬 Diagram : AI + Human Collaboration Model

🧭 How Wealth Advisors Can Prepare

If you’re a financial advisor, here’s how you can stay relevant in an AI-driven world:

- Understand AI Tools: Learn how algorithms make predictions.

- Enhance Emotional Intelligence: Focus on empathy — AI can’t replicate it.

- Build Transparency: Communicate how AI helps clients, not replaces you.

- Stay Compliant: Follow regulatory guidelines and ethical frameworks.

- Collaborate, Don’t Compete: Use AI as your assistant, not your rival

🧠 Final Thoughts: The Human Side of Smart Machines

AI has the power to make wealth management faster, smarter, and more inclusive — but only if it’s guided by strong ethical principles.

The real challenge isn’t building smarter algorithms — it’s ensuring they act in the best interest of people.

Because at the end of the day, wealth isn’t just numbers — it’s trust.

So as we step into the future of AI in finance, let’s make sure our technology stays human at heart. 💙