Agentic AI transforms insurance claims processing and fraud analytics with automation, accuracy, speed, and predictive intelligence. Learn benefits, use cases & future trends.

🧠 Introduction: The Insurance Industry’s Biggest Turning Point

Insurance companies are under pressure like never before — rising claims volume, customer expectations for instant decisions, and increasingly sophisticated fraud patterns. Traditional manual processes simply cannot keep up.

This is where Agentic AI steps in.

Unlike traditional automation or simple chatbots, Agentic AI can think, decide, learn, and act without human intervention. It can process claims end-to-end, detect fraud using patterns humans miss, and make decisions with accuracy and explainability.

In this article, you’ll learn:

- What Agentic AI really means (simple definition)

- How it works in claims processing

- Benefits for insurers, TPAs, and policyholders

- Real-world use cases

- Step-by-step implementation roadmap

- Tools, architecture, diagrams, and visuals

- Future trends shaping insurance in 2030

- SEO insights, keywords, and more

Let’s dive in.

⚙️ What Is Agentic AI? (Simple Definition)

Agentic AI refers to systems that can autonomously plan, reason, and perform tasks without needing constant human instructions.

Unlike traditional AI that only responds when asked, Agentic AI:

- Understands goals

- Breaks work into steps

- Executes workflows

- Learns from outcomes

- Makes decisions

- Self-improves over time

It acts like an intelligent insurance employee that never sleeps

📲 Why Insurance Needs Agentic AI Now

The insurance industry faces five major challenges:

📊 1. Rising Claims Volume

More customers, more policies → more claims. Manual teams can’t scale.

⚠️ 2. Increased Fraud Attempts

Fraud networks are using deepfakes, forged documents, synthetic IDs.

🕒 3. Long Processing Times

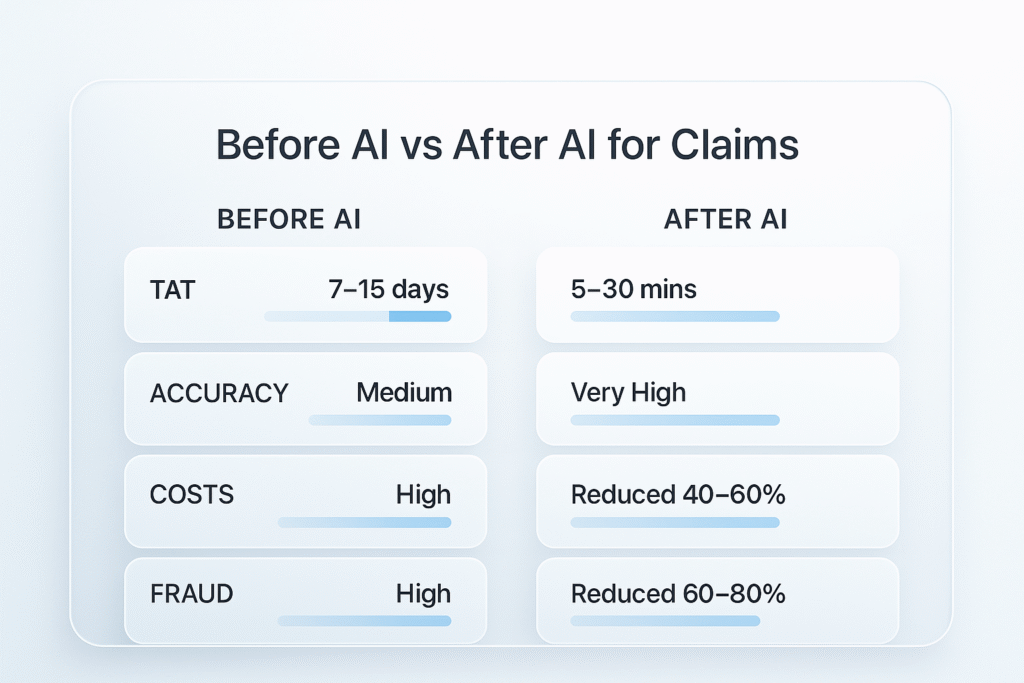

Customers expect instant approvals—not 7 to 15 days.

🧾 4. High Operational Costs

Claims and fraud units represent 30–40% of insurer expenses.

🔄 5. Compliance & Audit Pressure

Regulators demand transparency, audit trails, and fairness. Agentic AI solves these problems by automating, optimizing, and explaining decisions

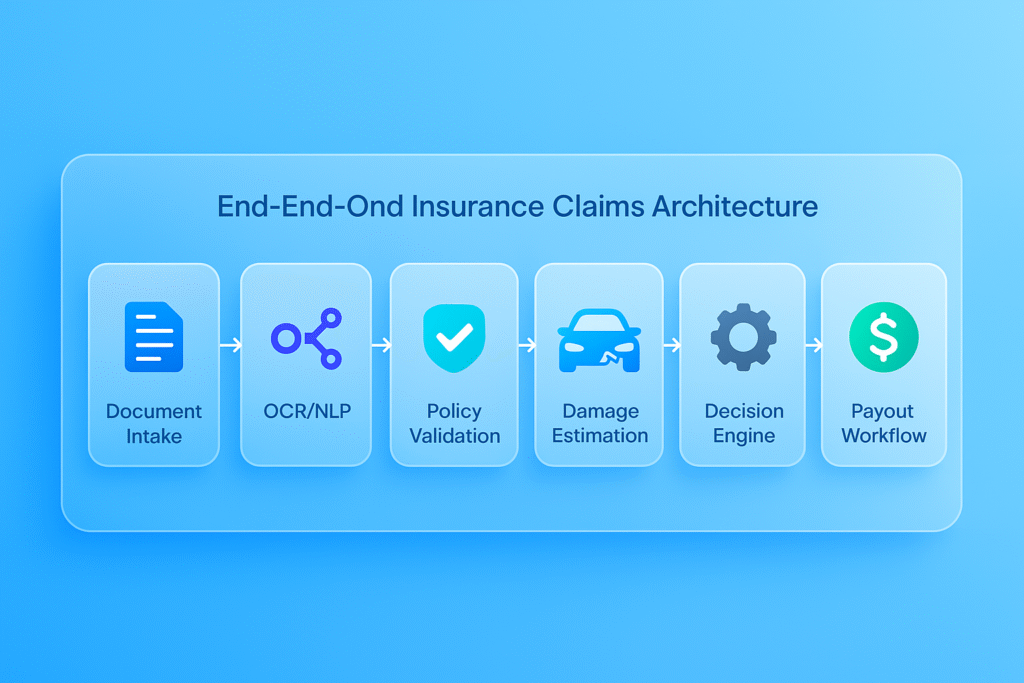

📊 How Agentic AI Works in Claims Processing (Step-by-Step)

1️⃣ Claim Intake & Document Understanding

Agentic AI extracts information automatically from:

- PDFs

- Photos

- Medical reports

- Invoices

- Police reports

- Videos

📌 Uses: Computer vision, OCR, NLP.

2️⃣ Policy & Coverage Validation

AI checks:

- Policy status

- Sum insured

- Co-payment

- Waiting periods

- Exclusions

- Deductibles

⚙️ Done through: Large Language Models (LLMs) + rule engines.

3️⃣ Damage Assessment (Auto, Health, Property)

AI models can:

- Read vehicle damage photos

- Interpret X-rays & prescriptions

- Analyze fire/flood property images

📈 Accuracy: 90–95% with real-world datasets.

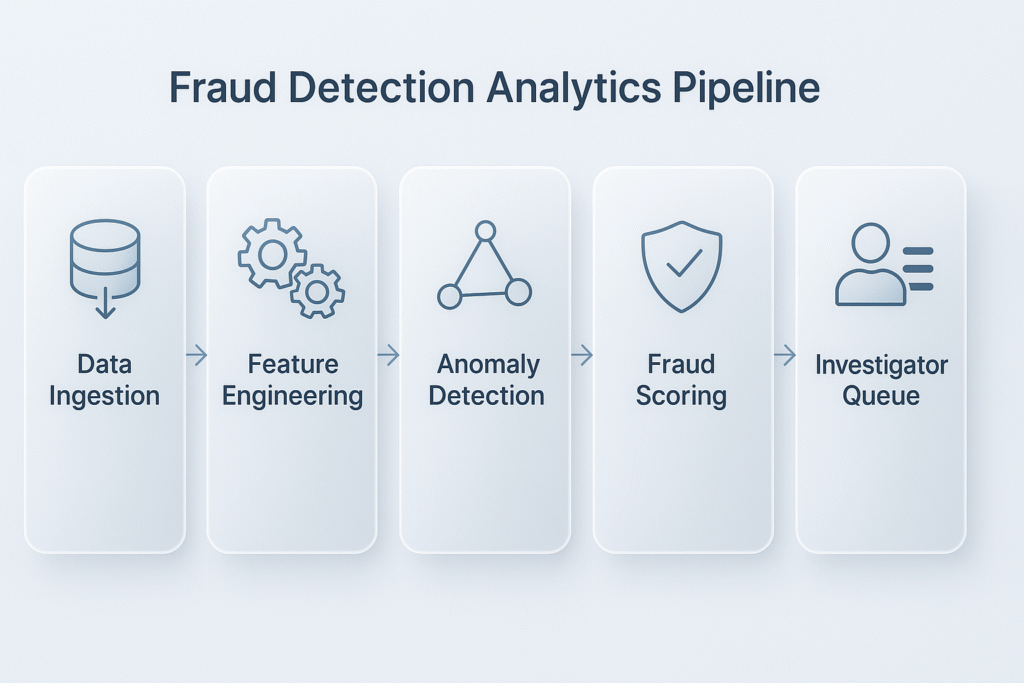

4️⃣ Fraud Risk Scoring

Agentic AI performs:

- Pattern detection

- Cross-customer comparison

- Network graph analysis

- Fake document detection

- Behavioural risk scoring

- Deepfake identification

🔍 Stops fraud before payout.

5️⃣ Decision Recommendation or Auto-Approval

Based on risk + rules + history:

- Low-risk claims get auto-approved

- High-risk claims go to human adjuster

📲 Standard approvals happen in minutes.

6️⃣ Workflow Automation

AI triggers tasks:

- Pay-out initiation

- Customer notifications

- Report generation

- Investigation alerts

⚙️ Integrates with: Guidewire, Duck Creek, Majesco, SAP, Salesforce

📈 Benefits of Agentic AI for Insurers

🏎️ 1. Faster Claim Settlements (Up to 70% Faster)

Automation reduces TAT from days → minutes.

💰 2. 40–60% Cost Reduction

Less manual work → lower operational cost.

🔒 3. Fraud Reduction by 50–80%

AI catches suspicious patterns that humans miss.

🔁 4. Zero Errors & High Accuracy

Consistent decisions → fewer disputes.

📞 5. Better Customer Satisfaction

Instant claim decisions boost trust.

📑 6. Complete Audit Trails

Every AI decision is documented → compliance friendly.

📊 Benefits for Policyholders

- Faster settlements

- Transparent decisions

- Reduced fraud → lower premiums

- 24×7 assistance

- Less paperwork

🏢 Benefits for Adjusters & Fraud Analysts

- AI handles low-complexity claims

- Analysts focus only on high-risk cases

- Improved investigation accuracy

- Less burnout, more productivity

🌍 Industry Use Cases (Practical Examples)

🏥 Health Insurance

- Medical bill validation

- Treatment verification

- Hospital fraud pattern detection

🚗 Motor Insurance

- Vehicle damage AI scoring

- Replacement part cost estimation

- Telematics-based fraud modelling

🏘️ Property Insurance

- Satellite image-based disaster claims

- Wildfire and flood assessment

- Drone image analytics

📦 Life & Term Insurance

- Death certificate verification

- Identity fraud scoring

- Beneficiary validation

🧭 Step-by-Step Implementation Roadmap

1. Start With High-Volume Claims

Motor & health -> best ROI.

2. Integrate OCR + LLM for Document Processing

Extract essential data with high accuracy.

3. Deploy Fraud Scoring Models

Use supervised + unsupervised models + graph analytics.

4. Introduce Auto-Approvals

Start with low-risk claims.

5. Build Human-in-the-Loop Workflows

Humans review high-risk cases.

6. Automate End-to-End Claims

Payout initiation + audit logs + customer communication.

7. Scale Across All Lines of Business

Property, life, travel, crop, marine.

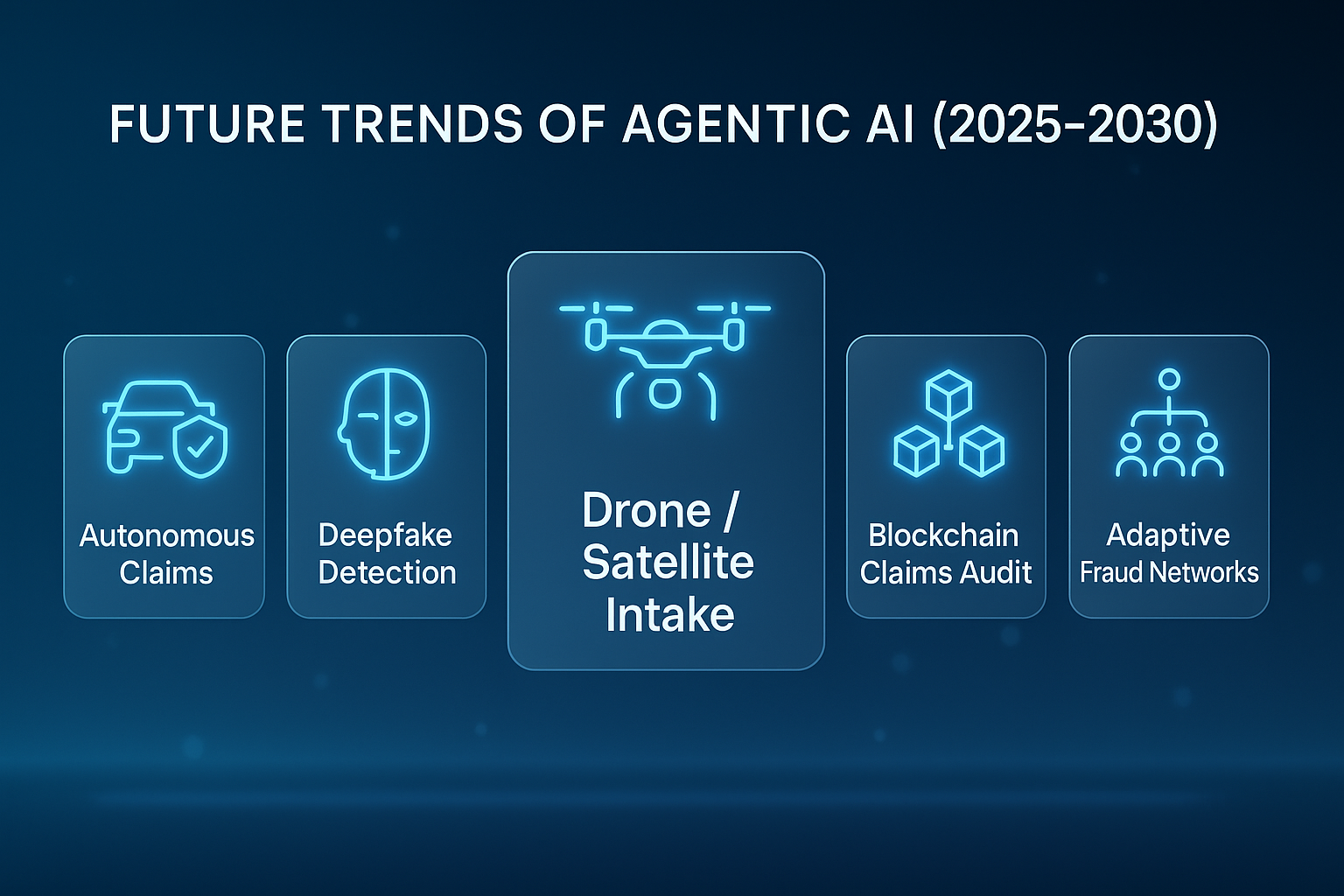

🌍 Future Trends of Agentic AI in Insurance (2025–2030)

🔍 1. AI-Generated Video Evidence Validation

Detecting deepfake claims.

🤖 2. Fully Autonomous Claims Handlers

AI agents managing 100% of simple claims.

📡 3. Satellite + Drone + IoT Integration

Real-time risk scoring.

🔄 4. Dynamic Fraud Networks

Self-learning fraud detection graphs.

🔐 5. Zero Trust Claims

Blockchain + AI for tamper-proof claims.

💬 6. Voice-Based Claim Filing

Alexa/Siri-like assistants for insurance.

📈 7. On-Chain Micro-Insurance Smart contracts + AI → instant payouts

💡 Conclusion

Agentic AI is not a future concept — it’s already transforming claims and fraud operations around the world. Insurers using Agentic AI are experiencing:

- Faster payout cycles

- Massive cost reductions

- Higher customer satisfaction

- Lower fraud losses

- Better compliance and reporting

The next 5 years will create a huge competitive gap between insurers who adopt Agentic AI early and those who don’t. Now is the best time to modernize and build an intelligent, automated, fraud-resistant insurance ecosystem